$425M Capital One Settlement: If you’ve held a Capital One 360 Savings account between September 18, 2019, and June 16, 2025, you’re in the right spot. The bank has agreed to a massive $425 million settlement because it allegedly kept interest rates low on these accounts compared to its 360 Performance Savings accounts with higher rates. This article breaks down everything—from eligibility to the claim process—in a clear, conversational style that’s easy to follow for everyday savers and professionals alike.

Table of Contents

$425M Capital One Settlement

The Capital One $425 million settlement is a rare shot to reclaim hundreds, maybe thousands, of dollars in lost interest. Millions of Americans are eligible, but the October 2, 2025 deadline is firm. Act now, claim your payout, and secure what’s yours from years of unfair banking practices. Stay informed, choose the right account products in the future, and protect yourself from scams to keep your wealth growing strong.

| Topic | Details |

|---|---|

| Settlement Amount | $425 million |

| Eligible Customers | Capital One 360 Savings account holders, Sept 18, 2019 – June 16, 2025 |

| Claim Deadline | October 2, 2025 |

| Final Court Approval Hearing | November 6, 2025 |

| Estimated Lost Interest | Over $2 billion according to CFPB |

| How to Claim | Use mailed ID and PIN to select payment option online |

| Payment Options | Direct deposit or mailed check; extra interest if account open after Oct 2, 2025 |

| Official Website | capitalone360savingsaccountlitigation.com |

What’s Going Down? The Big Picture

Between 2019 and 2025, the U.S. economy saw significant shifts in Federal Reserve interest rates. During this time, Capital One introduced the 360 Performance Savings, which offered significantly higher rates than the older 360 Savings accounts. For example, as of late 2023, 360 Performance Savings rates hit about 4.35% APY, while legacy 360 Savings accounts stayed stuck near 0.3% to 1.0%. Capital One’s website silently swapped the 360 Savings out, steering new customers to the Performance account but left existing 360 Savers locked in lower rates with little or no notice.

The result? Capital One allegedly pocketed billions while leaving millions of customers with unfairly low interest income. The Consumer Financial Protection Bureau (CFPB)—the watchdog for consumers’ financial rights—stepped in to investigate, leading to this large $425 million settlement to compensate affected customers.

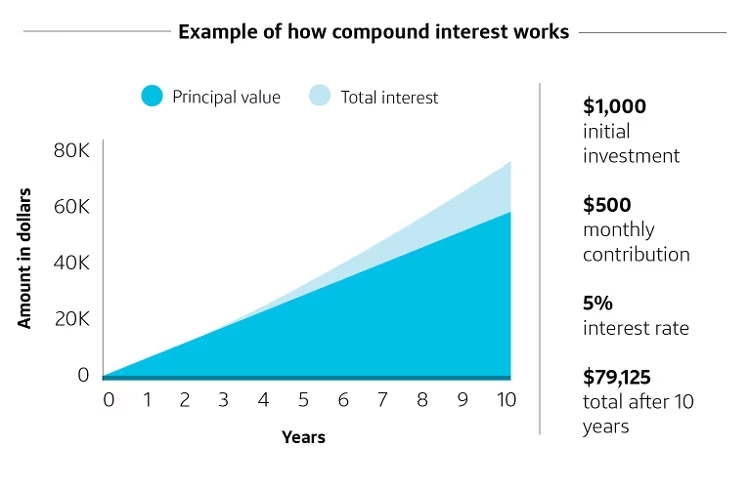

Understanding Savings Account Interest Rates and Why They Matter

Savings accounts pay you interest based on the Annual Percentage Yield (APY). Simply put, APY measures how much your money grows in one year. When Capital One held the 360 Savings accounts at around 0.3%-1.0% APY, customers were getting crumbs compared to the higher rates offered on the 360 Performance Savings account, which at times exceeded 4%. For an average saver with $10,000, that difference can add up to hundreds of dollars yearly.

Imagine working a side gig and discovering someone else doing the same job for double the pay. That’s how many 360 Savings customers felt when the truth came out.

Who’s Eligible and How Much Could You Make?

Eligibility covers anyone who held a 360 Savings account at any moment between September 2019 and June 16, 2025. It includes closed accounts too. How much you get depends on how long you held the account and the balance, calculated as lost interest compared to the higher 360 Performance rates.

For example, a saver with $5,000 in their account for several years potentially lost about $250 to $700 in interest during this period. Account holders who keep their accounts open after October 2, 2025, qualify for bonus interest payments from a $125 million pool, adding even more dough to their payout.

Step-By-Step Guide to Claim Your $425M Capital One Settlement

- Look out for the official mailing. Eligible customers received an ID and PIN by mail to access the claim portal.

- Visit the official settlement website: capitalone360savingsaccountlitigation.com.

- Log in with your ID and PIN to confirm eligibility.

- Pick a payment method: direct deposit is fastest; checks via mail are also available.

- Submit your claim and verify details carefully.

- Keep your 360 Savings account open past October 2, 2025 to qualify for extra interest payments.

- Deadline alert: Claims must be submitted by October 2, 2025—isn’t worth missing!

- Court approval set for November 6, 2025; payments will roll out afterward.

If you didn’t get your mail or lost your credentials, call 1-855-604-1811 or use the website contact form. Never share sensitive info with unverified sources.

Safety First: Beware of Scams

Unfortunately, big settlements attract scammers. Protect yourself by:

- Using only the official website and phone numbers.

- Never paying fees to claim money.

- Not giving passwords or social security numbers to non-official callers.

- Reporting suspicious contacts immediately.

Tax Implications You Should Know About

Settlement money typically counts as taxable income. Consult a tax professional or visit irs.gov to understand how to handle your payout for tax season so you’re not caught off guard.

If You’re Not Happy: Objecting or Excluding Yourself

Not feeling the settlement’s terms? You can file an objection or ask to be excluded before the court hearing on November 6, 2025. This info is with the settlement notice or on the official website.

Consumer Watch: CFPB’s Vital Role

The CFPB enforces consumer protection laws for financial products. Their involvement ensured the spotlight was on Capital One’s practices, pushing for fair compensation.

How Capital One’s Savings Rates Changed Over Time?

Originally, Capital One’s 360 Savings was touted as a “high interest” account offering appealing rates. However, as Federal Reserve rates climbed in 2022 and 2023, Capital One quietly froze the 360 Savings rates keeping them below market standards (around 0.3%). Meanwhile, the newly launched 360 Performance Savings account saw rates climbing up to 4.35% APY.

When customers searched for competitive high-yield accounts, Capital One directed new clients to 360 Performance, but many existing customers got stuck in inferior accounts without clear notification. This discrepancy fueled the lawsuit and settlement.

Despite the settlement, Capital One continues to offer competitive rates on its 360 Performance Savings account, currently around 3.6% APY, making it still attractive for savers today.

Past Bank Settlements Put This in Perspective

Capital One’s $425 million settlement joins a list of notable bank payouts:

- Wells Fargo’s $142M settlement over overdraft fees (2023).

- JPMorgan Chase’s $270M settlement regarding mortgage servicing (2021).

These cases emphasize that banks are increasingly held accountable for fair customer treatment.

What This Means for Future Capital One Customers?

You can expect Capital One to improve transparency and savings product features after this settlement. They’ll likely enhance disclosures and interest rate adjustments to maintain customer trust.

Voices from the Frontlines

Legal expert Jane Adams highlights, “This settlement is a major win for everyday savers, making clear that banks must walk the talk on rates.” Consumer advocacy group SaveOurSavings states, “Capital One’s actions remind us that vigilance and clear info are essential for protecting consumers.”

$425M Capital One Class Action Settlement: What Customers Need to Know in 2025

Verizon Class Action Lawsuit Settlement 2025 – How to Claim Your Share Before the Deadline

Cash App $12.5M Settlement Over Spam Text Class Action; You can get $147, Check Eligibility