$425M Capital One Settlement: If you held a Capital One 360 Savings account between September 18, 2019, and June 16, 2025, you could be eligible for a share of a massive $425 million settlement. This settlement stems from allegations that Capital One misled its customers by paying artificially low interest rates on their 360 Savings accounts while promoting a new, higher yielding product. Whether you’re a casual saver or a financial professional, this guide breaks down everything you need to know—from the lawsuit background, through detailed explanations of the settlement, to practical advice on how to claim your money before the deadline. This article keeps it straightforward and friendly for everyone, while providing valuable insights for experts and consumers alike.

Table of Contents

$425M Capital One Settlement

The Capital One $425 million settlement is a crucial reminder for all savers to stay alert and informed. If you held a 360 Savings account during the eligible period, don’t miss the October 2 deadline to claim your payout. This case illustrates how your vigilance and collective action can hold banks accountable and recover what’s rightfully yours. Protect your money, claim what you’re owed, and stay savvy in managing your savings.

| Topic | Details |

|---|---|

| Settlement Amount | $425 million total |

| Eligible Accounts | Capital One 360 Savings accounts held between Sept. 18, 2019 – June 16, 2025 |

| Payment Breakdown | $300 million cash payout + $125 million allocated for future interest payments |

| Claim Deadline | October 2, 2025 (final date to select payment method) |

| Claim Process | No claim needed to receive payment; must select payment method by deadline |

| Payment Boost | Closing account before deadline increases cash payout by about 15% |

| Court Approval Date | November 6, 2025 |

| Official Website | capitalone360savingsaccountlitigation.com |

What Led to the $425M Capital One Settlement? A Detailed Background

Capital One introduced the 360 Savings account in 2013 as their flagship high-interest online savings product. For the better part of the next six years, it was consistently marketed as an attractive way to grow your money with good interest rates.

From 2019 onward, however, as the general market interest rates began to rise, Capital One changed course. Instead of increasing rates on the existing 360 Savings accounts, they quietly withdrew it from their website on September 16, 2019, and introduced a new product called 360 Performance Savings. This new account offered significantly higher interest rates—initially around 1.9% APY compared to just 1.0% APY for the older 360 Savings.

Here’s where things got tricky: Capital One left existing 360 Savings account holders on the lower interest rates, without informing them that a better product existed. The 360 Savings account was removed from public view, creating the false impression that the 360 Performance Savings was the only high-yield savings product offered by Capital One. This left long-time customers earning as low as 0.3% APY — even as the Fed raised rates aggressively and competitors increased their rates accordingly.

By the end of 2023, the rates on the 360 Performance Savings had climbed to over 4.3% APY, while the old 360 Savings accounts were stuck at 0.3% APY — a dramatic and unfair divergence.

The lawsuit alleged that Capital One breached its duty of good faith and fair dealing—a legal obligation that banks act honestly and fairly in managing accounts. By misleading customers and withholding higher rates, Capital One caused millions of savers to lose billions in potential interest earnings. This case eventually led to the $425 million settlement approved by a federal court.

How Do Class Actions Work and Why Does This Matter?

Class action lawsuits let a large group of people who suffered the same harm come together to sue a company. Instead of individual lawsuits, the class collectively demands justice and compensation, which otherwise would be difficult or costly to pursue alone.

This settlement is important because it shows how legal action can hold big banks accountable. It ensures customers harmed by deceptive practices receive compensation and helps set higher standards for transparency and fairness in the banking industry.

$425M Capital One Settlement Breakdown: What You Can Expect

The $425 million settlement is split into two key funding pools:

- $300 million in cash payouts:

Distributed based on your average account balances and the length of time you held the 360 Savings account during the covered period (Sept 18, 2019 – June 16, 2025). - $125 million for future interest payments:

For customers who keep their 360 Savings accounts open past the settlement deadline, this pool ensures they get higher interest payments going forward.

The best part? You don’t need to fill out a claim form to get your payment. The settlement administrator will automatically identify eligible customers. However, you must select your preferred payment method (check or direct deposit) by October 2, 2025. Accounts that get closed by this date may receive approximately 15% larger payments.

The court will give its final approval on November 6, 2025, with payments distributed soon after.usatoday+3

Sample Payout Examples for Perspective

To help you understand what to expect, here’s a rough idea of payouts based on typical balances:

- If you had an average balance of $10,000 during the eligible period, your payout might be around $150 to $200 in cash.

- Choosing to close your account by the deadline could add an extra 15% bonus, meaning an additional $20 to $30.

- Keeping your account open after the deadline qualifies you for future boosted interest payments funded by the $125 million pool.

These numbers represent a fair share of the interest you missed out on due to Capital One’s misleading practices.

Detailed Step-by-Step Guide: How to Claim Your Money

If you think you’re eligible, here’s how to get your payment:

- Verify Your Eligibility:

Check if you held a Capital One 360 Savings account between September 18, 2019, and June 16, 2025. - Look for Your Settlement Notice:

You’ll receive a mailed notice with a unique ID and PIN, which you’ll need to log in and select your payment option. - Visit the Official Website:

Go to capitalone360savingsaccountlitigation.com. - Log in Using Your ID and PIN:

This link lets you securely select how you want to receive your payout. - Choose Your Payment Method:

Select electronic deposit or a mailed check. - Decide to Keep or Close Your Account:

Opt to keep your account open to earn future interest payments, or close it before the deadline to receive a bit more cash now. - Receive Your Payment:

After court approval on November 6, 2025, payments will be sent to you automatically.

If you missed the notice, contact the administrators via the official website as soon as possible.

Why This Settlement Matters for Savers and Finance Pros?

This case offers several important lessons:

- Banks must be transparent: Hidden products or rates can rob savers of earnings.

- Stay vigilant: Constantly check your accounts and compare rates.

- Class actions pack power: Collective legal actions can recover huge sums for consumers.

- Financial awareness protects wealth: Knowing your rights and market conditions empowers better decisions.

For financial advisors and professionals, it’s a reminder to educate clients about checking product terms and comparing rates regularly.

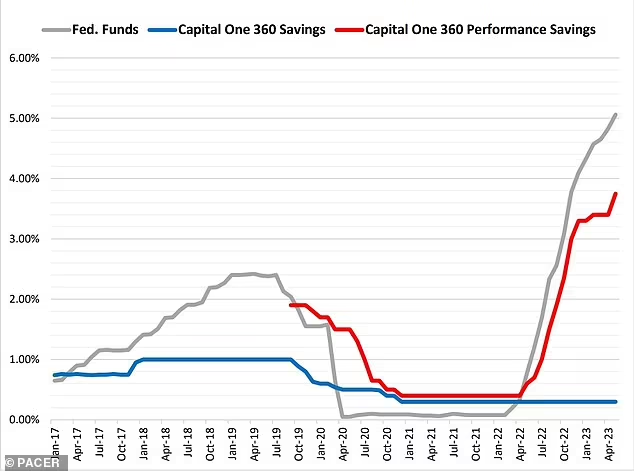

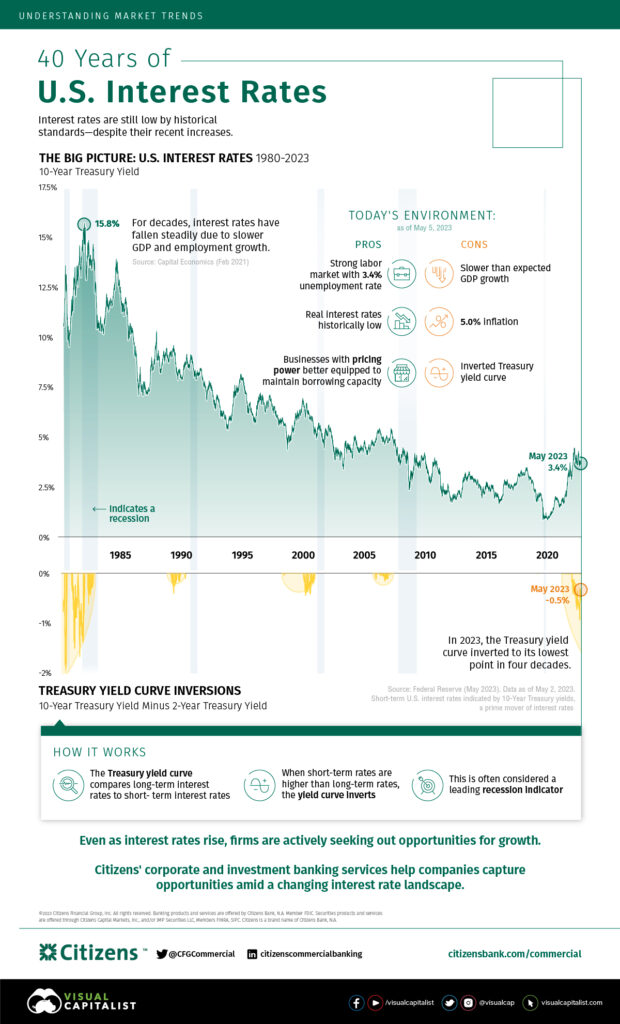

The Interest Rate Landscape (2019-2025)

During the covered period, Federal Reserve interest rates varied dramatically:

- In early 2020, the Fed dropped rates nearly to zero due to the pandemic.

- Most banks, including Capital One, followed by lowering savings rates to minimal levels.

- Beginning in mid-2022, the Fed hiked rates aggressively to fight inflation, pushing national savings rates higher.

- While competitors raised rates to 3-4% APY, Capital One’s 360 Savings stuck stubbornly at ~0.3% starting late 2020.

- Meanwhile, its new 360 Performance Savings account offered competitive rates, reaching over 4.3% APY by 2025.

How to Protect Yourself from Low Rates and Banking Tricks?

- Compare and shop around: Monitor rates using sites like Bankrate or NerdWallet.

- Read account terms closely: Know if you’re locked into low rates.

- Watch for product changes: New accounts may offer better rates but won’t switch you automatically.

- Question your bank: If rates drop, ask if better options are available.

- Use watchdog agencies: Stay informed through CFPB and state attorney general announcements.

- Diversify savings vehicles: Consider CDs or money market accounts for better yields.

Cash App $12.5M Settlement Over Spam Text Class Action; You can get $147, Check Eligibility

$5,000 Wells Fargo Settlement 2025: How to Claim Your Share Today

Capital One Settlement in October 2025: Who’s Getting Paid & How to Claim Your Share