£4,200 Income Boost for Pensioners: If you’re a pensioner in the United Kingdom, October 2025 is shaping up to be a crucial month for your finances. The Department for Work and Pensions (DWP) is set to roll out a significant income boost of up to £4,200, alongside the usual state pension increase. This article breaks down everything UK pensioners need to know about this financial boost—how to claim it, what it means for your monthly income, and practical tips to get the most out of your benefits. Written clearly and conversationally, this guide will help both retirees and pension planners understand the essential updates, with expert insight and step-by-step advice to empower your financial planning in 2025.

Table of Contents

£4,200 Income Boost for Pensioners

October 2025 heralds an important financial boost for UK pensioners, combining a 4.1% State Pension increase with potential additional income worth up to £4,200 through governmental support schemes. This income boost is designed to ease the rising cost of living and provide safety for pensioners facing financial pressures. By checking eligibility, claiming Pension Credit, staying updated with DWP communications, and exploring supplemental support programs, pensioners can fully maximize their entitlements in 2025.

| Feature | Details |

|---|---|

| State Pension Increase | 4.1% rise starting April 2025, raising average weekly payments |

| Additional Income Boost | Up to £4,200 available in extra support payments across 2025 |

| Pension Credit Eligibility | Key for accessing many of the extra income support schemes |

| State Pension Age | Usually 66-67, rising to 68 for some birth years |

| Claiming Method | Automatic payments for existing claimants; new claimants apply via DWP |

| Support for Energy Bills | Significant relief via the Energy Bills Support Scheme and Winter Fuel Payment |

| Official Source | Department for Work and Pensions (DWP) |

What Is the £4,200 Income Boost for Pensioners?

In October 2025, the DWP is introducing a combination of increases and one-off payments designed to support pensioners in managing rising living costs such as energy bills, food, and healthcare

- The standard State Pension will increase by roughly 4.1% from April 2025, reflecting the government’s “triple lock” policy that adjusts pensions according to inflation, wage growth, or a minimum of 2.5%—whichever is higher.

- Beyond this, DWP is issuing additional payments or one-off boosts through cost-of-living payments and targeted support programs. These are designed especially to ease the financial burden caused by inflation and rising energy prices.

- For many pensioners, especially those receiving pension credit or other means-tested benefits, this can add up to an extra £4,200 or more in total income through the fiscal year.

Why Does This Boost Matter?

Rising costs in the UK have put a heavy strain on pensioners, many of whom rely almost entirely on fixed incomes. Household bills, especially for heating and electricity, have soared in recent years, along with prices for food, transport, and medicine.

This income boost is the government’s approach to providing relief and ensuring pensioners don’t go without essentials. Not only does it support basic daily living, but it also protects vulnerable older adults from poverty and financial hardship.

Moreover, because pensioners typically spend a larger share of their income on essentials like housing and energy, inflation hits them harder than the average household. The £4,200 boost helps offset these rising costs, which if unaddressed, can seriously affect health and wellbeing.

What to Expect from the State Pension in 2025?

The State Pension saw a 4.1% uplift from April 2025, meaning those receiving the full new State Pension can expect to get around £230 per week, up from approximately £221 in 2024

- This increase is part of the government’s triple lock guarantee, which ensures pension payments rise each year by the highest of inflation, average wage increase, or 2.5%. In 2025, inflation was most significant, driving up the pension by 4.1%.

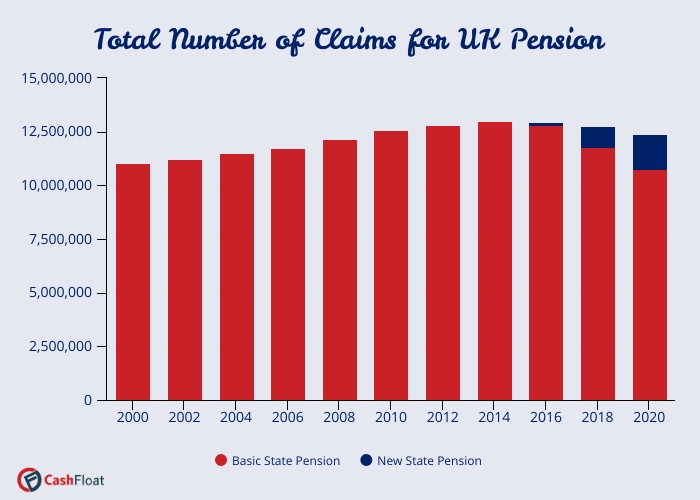

- The basic (or ‘old’ state) pension, which many pensioners still receive depending on their National Insurance contributions prior to 2016, similarly rose to about £176 per week.

- People receiving Pension Credit—a benefit that tops up income for those on lower earnings—will find their entitlement adjusted accordingly, ensuring they meet a minimum guaranteed income.

- It’s important to check your pension statement regularly either online or by post, so you’re aware of your payment rates and can plan your finances accordingly.

What if You Haven’t Claimed Your Pension Yet?

If you’re approaching State Pension age but haven’t claimed your pension yet, don’t delay. Applying as soon as eligible is crucial because your pension payments don’t start automatically. Once claimed, payments will be backdated to the date you reached your pension age, but delayed claims can result in missing out on money you could have had.

Claiming early can sometimes reduce your entitlement, so it’s wise to check your options carefully with a financial advisor or the government’s pension calculator.

How to Claim £4,200 Income Boost for Pensioners?

Step 1: Check Your Pension Eligibility and Entitlements

If you’re unsure about your State Pension entitlement or when to claim, start by visiting the government’s official online tool at gov.uk/check-state-pension. It provides an estimate based on your National Insurance record.

Step 2: Apply for State Pension or Pension Credit

Payments are automatic for existing claimants, but if you haven’t claimed the State Pension or Pension Credit, you need to apply as soon as you reach your qualifying age. Applications are available on the DWP website, or by telephone, and you can also request paper forms.

Pension Credit is especially important because it unlocks access to additional top-ups and support schemes, such as the Warm Home Discount or reduced council tax.

Step 3: Make Sure Your Details Are Up to Date

Stay in touch with DWP by updating your address, bank account, or contact information to avoid delays or missed payments.

Step 4: Monitor Official Communications

Keep an eye on letters and notifications from DWP, especially in October 2025 when the new one-off payments are scheduled to be paid. These communications will provide details on payment amounts and processes.

Step 5: Claim Other Support You May Be Eligible For

In addition to pension payments, pensioners can benefit from schemes like the Winter Fuel Payment, the Cold Weather Payment, and the Energy Bills Support Scheme. These provide targeted financial help during winter months and for those on low incomes.

Practical Tips to Maximize Your Pension Income in 2025

Navigating pension payments and government schemes can feel overwhelming, so here are some practical ways to ensure you get the maximum benefit:

- Apply for Pension Credit: Even if you think you might not qualify, it’s worth checking because it unlocks many other benefits and one-off payments.

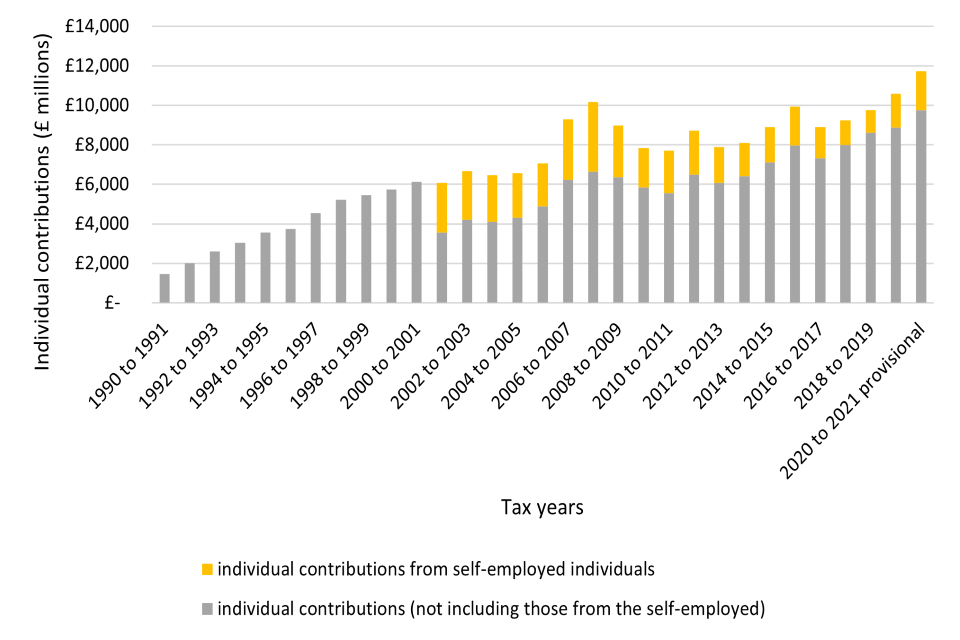

- Check Your National Insurance Record: Missing contributions could reduce your pension. You can make voluntary contributions to fill gaps if eligible.

- Explore Local Authority Help: Some councils offer additional support, such as free bus passes, help with home insulation, or council tax reduction schemes.

- Use Budgeting Tools: Track your income and expenses carefully, especially with rising living costs. Many charities and government websites offer free budgeting guides tailored for pensioners.

- Stay Informed About Energy Schemes: The Energy Bills Support Scheme offers discounts on energy bills, and switching tariffs to a more affordable plan could save money monthly.

- Seek Financial Advice: Many banks and charities offer free advice for pensioners about maximizing benefits, managing savings, or planning for lasting security.

How the £4,200 Income Boost for Pensioners Helps Real People: Case Study of Tom and Sheila

Tom and Sheila, both in their early 70s and living in Manchester, rely primarily on the State Pension for their income. After the April 2025 increase plus the additional support payments in October, they anticipate around £250 extra per month combined.

For Tom and Sheila, this extra money means:

- Keeping on top of their gas and electricity bills without using their savings.

- Budgeting for annual prescription charges and minor home repairs like boiler maintenance.

- Having a small buffer for unexpected expenses like dental work.

Their story mirrors that of thousands of pensioners who face tough decisions every winter — heating or eating? These extra payments help tip the balance in favor of wellbeing.

Are You Missing £8,300? DWP Urges Pensioners to Check for Back Payments Now

£4,200 Pension Credit Boost in 2025: Check Eligibility Criteria and Application Process

Born After This Date? You Could Lose £13,000 in 2026; Experts Warn of ‘Pensions Steal’