$400 Increase In CPP/OAS Benefits: If you’ve scrolled through social media lately, you’ve probably seen headlines screaming: “Seniors to get $400 more in CPP/OAS this October!”

Sounds great, right? But before you start planning that vacation or adding to your grocery budget, let’s hit pause and look at the facts. The truth is, there’s no official $400 increase scheduled for October 2025. What’s actually happening is a smaller cost-of-living adjustment (COLA) to Old Age Security (OAS) and Canada Pension Plan (CPP) benefits—an inflation-linked raise that helps retirees keep up with rising costs. This guide walks you through what’s really changing, when you’ll see it, and how to confirm your new payment amount safely and confidently.

$400 Increase In CPP/OAS Benefits

Let’s set the record straight: there’s no $400 monthly increase coming for CPP or OAS in October 2025. What seniors will see instead is a modest cost-of-living adjustment—about 0.7%—which keeps pace with inflation and ensures benefits remain stable. For most retirees, that means a few extra dollars a month. It may not sound like much, but over years, those steady increases protect the buying power that seniors rely on. If you already receive CPP or OAS, you’ll automatically get the new rate on October 29, 2025—no forms, no re-applications, no phone calls required. Consistent, data-driven adjustments may not grab headlines, but they quietly sustain the financial foundation of Canadian retirement.

| Topic | What You Need to Know | Source / Official Link |

|---|---|---|

| Official OAS increase (Oct–Dec 2025) | ~0.7% cost-of-living boost | Government of Canada – OAS benefits |

| OAS maximums (Oct–Dec 2025) | Up to $740.09 (ages 65–74), $814.10 (75+) | Same link |

| CPP increase | Inflation-based; not $400 | Government of Canada – CPP benefits |

| Payment date for Oct 2025 | October 29, 2025 | GoC Payment Calendar |

| GIS (Guaranteed Income Supplement) | Adjusted with inflation | GIS info |

Understanding CPP and OAS

The Canada Pension Plan (CPP) and Old Age Security (OAS) form the backbone of Canada’s retirement income system.

- CPP is a contributory plan—workers pay into it throughout their careers, and those contributions determine their retirement income.

- OAS is a residency-based benefit—funded through general tax revenue, not personal contributions. It’s available to most Canadians 65 or older who have lived in the country for at least 10 years after turning 18.

Both are designed to protect seniors from losing purchasing power as prices rise. That’s why benefits are indexed to the Consumer Price Index (CPI)—the same inflation measure that tracks changes in the cost of groceries, rent, transportation, and utilities.

Why People Are Talking About a $400 Increase In CPP/OAS Benefits?

Here’s where things got murky. Over the summer, posts began circulating on Facebook and YouTube claiming that a $400 OAS increase was on the way. Some even shared fake screenshots of “official” announcements.

But a quick check on canada.ca shows nothing of the sort.

The likely confusion comes from:

- Misreading annual totals – Some writers multiplied small monthly increases over 12 months and presented the total as a single monthly boost.

- Mixing programs – Combining CPP, OAS, GIS, and provincial supplements could total hundreds per year.

- Outdated announcements – A 2022 policy gave higher OAS to those 75+, and some users recycled those headlines.

So, while there is an increase, it’s closer to a few dollars—not $400.

How Much Will You Actually Get?

Let’s crunch real-world numbers.

Example 1: Moderate Recipient

- OAS benefit (age 68): $730.00/month

- Increase: 0.7% → $735.11/month

That’s a $5.11 bump.

Example 2: Higher Recipient (75+)

- OAS benefit: $810.00/month

- Increase: 0.7% → $815.67/month

A gain of $5.67 per month.

Example 3: CPP average pensioner

- CPP average (2025 est.): $780/month

- Increase (approx. 1% annually): $787.80/month

That’s around $7.80 more per month.

While these numbers may seem small, they’re designed to maintain stability rather than provide windfalls.

What Is the Cost-of-Living Adjustment (COLA)?

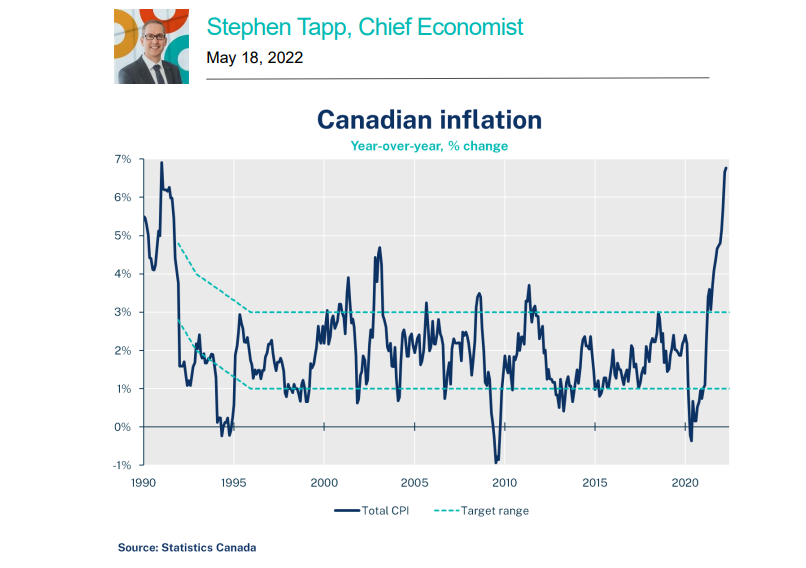

COLA is an automatic adjustment applied quarterly (for OAS) and annually (for CPP) based on the Consumer Price Index.

If inflation is high, you’ll see a bigger bump; if it slows, the increase shrinks. The Bank of Canada targets a 2% inflation rate, so a 0.7% quarterly increase is consistent with that goal.

According to Statistics Canada, the average inflation rate in 2024 was around 2.8%, driven largely by housing and food costs. If inflation trends stay stable, we can expect similar OAS adjustments through 2026.

Payment Date and Timeline

The government issues CPP and OAS payments on the same day each month.

For October 2025, the payment date is Wednesday, October 29. That deposit will include the new, adjusted benefit.

If your payments are late, Service Canada advises waiting five business days before contacting them.

How to Check Your Payment Safely?

To verify your new benefit amount:

- Log into My Service Canada Account (MSCA) at servicecanada.gc.ca.

- Select View My OAS/CPP payments.

- Compare September 2025 and October 2025 statements.

- Confirm a slight increase—around 0.7%.

- Verify your direct deposit details are current.

Never click links in unsolicited texts or emails claiming to offer “early access” to the raise. The government never asks for your SIN, bank details, or passwords by email.

If you prefer, you can also view printed statements mailed quarterly.

GIS and Provincial Supplements

Low-income seniors may also receive the Guaranteed Income Supplement (GIS), which tops up OAS payments. The GIS amount is based on your income and adjusted quarterly for inflation as well.

For October–December 2025, expect a modest rise consistent with the OAS increase. The maximum GIS payment for singles currently sits around $1,072 per month, while couples may receive up to $1,292 combined, depending on income.

Several provinces—like Ontario (GAINS), British Columbia (SAFER), and Quebec (Soutien aux aînés)—offer additional supplements. These too often follow federal indexation patterns.

Who Qualifies for the $400 Increase In CPP/OAS Benefits?

You’ll automatically receive the October 2025 increase if:

- You’re currently receiving OAS or CPP.

- You meet age and residency rules (for OAS).

- You haven’t opted to defer or suspend payments.

You won’t see an increase if:

- You haven’t applied yet.

- You live abroad without enough Canadian residency years.

- Your OAS is fully or partially clawed back because your income exceeds about $90,997 (the 2024 threshold; updated yearly).

Real-Life Example

Let’s meet Marilyn, 68, retired in Manitoba.

She receives:

- OAS: $720/month

- CPP: $780/month

- GIS: $250/month

Her total September 2025 income = $1,750/month.

After the October 2025 increase:

- OAS: $724.12

- CPP: $787.80

- GIS: $251.50

Her total monthly income rises to about $1,763.42 — a $13.42 difference.

Not earth-shattering, but enough to cover a few extra grocery items or an electricity bill increase.

The Bigger Picture: Why Small Increases Matter

While a few dollars may not sound like much, over a lifetime, these adjustments protect the financial dignity of millions of seniors.

Consider this: Without inflation indexing, someone who retired in 2000 with $500 in OAS would still be earning $500 today—worth only about $320 in real 2025 dollars.

Instead, because of indexing, that person now receives over $700. That’s how these small, steady raises preserve purchasing power.

Financial planners emphasize that while OAS and CPP are vital, they’re designed to replace only 25%–40% of your pre-retirement income. That means personal savings, RRSPs, or pensions remain essential for long-term comfort.

Advice from Professionals

Certified Financial Planner (CFP) advisors recommend that seniors:

- Revisit their retirement budgets annually to account for inflation.

- Use Tax-Free Savings Accounts (TFSAs) to supplement income without affecting GIS eligibility.

- Keep My Service Canada login credentials private and update banking details promptly to prevent delays.

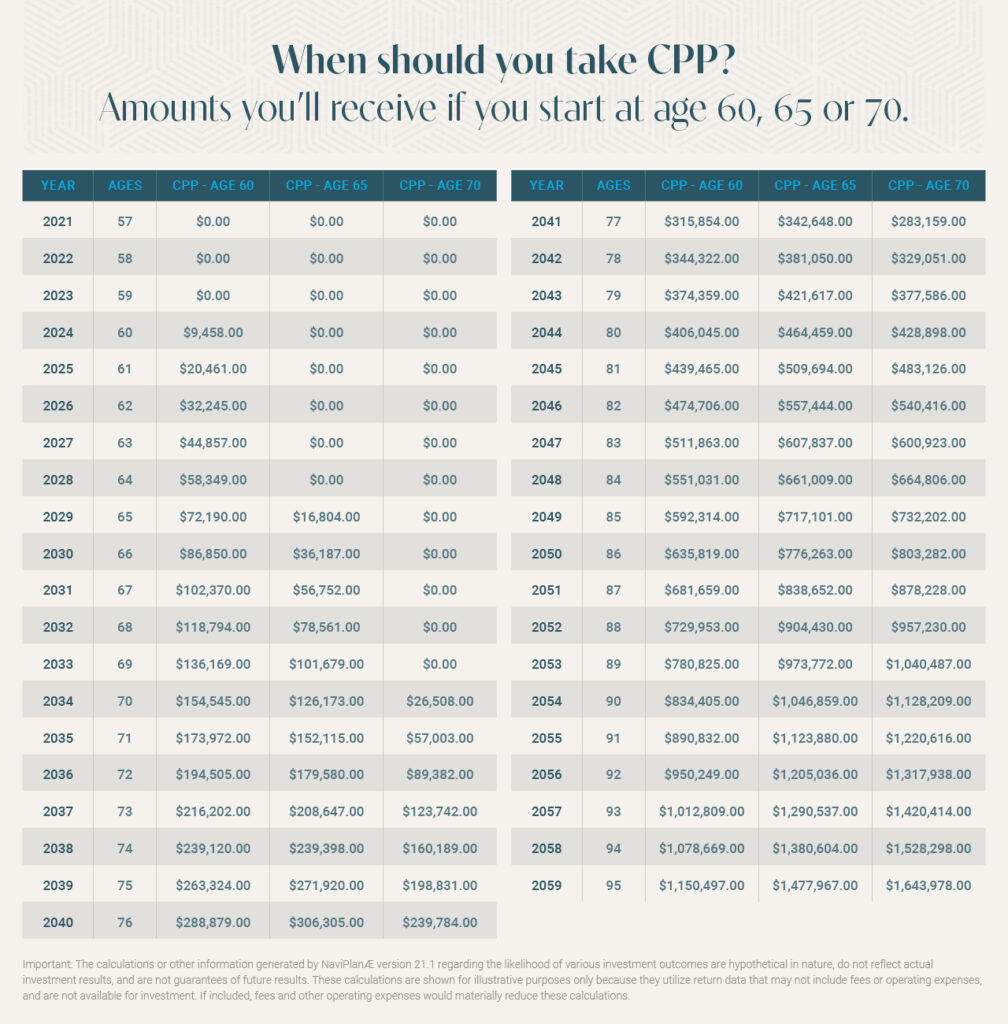

- Review OAS deferral options: you can delay OAS up to age 70 for a higher monthly amount.

Beware of Scams and False Claims

Whenever benefit rumors circulate, scammers move fast. They might send texts or emails saying:

“Congratulations! You qualify for a $400 OAS bonus. Click here to claim.”

Don’t fall for it. The Government of Canada never sends such messages.

Canada Revenue Agency Dodges Key Question: How Many Call Centre Workers Are Coming?

Canada Housing Benefit $500 Payment in October 2025: Are You Eligible to Get it?