$3,831, $4,018, $5,108 Social Security Payments: If you’re hearing buzz about Social Security payments of $3,831, $4,018, and $5,108 hitting accounts this October 2025 and wondering how to get that kind of cash, you’re in the right place. Let’s break down what these numbers mean, who qualifies, and how you can maximize your benefits. Whether you’re planning your retirement, curious about how Social Security works, or managing your finances now, this guide has your back with clear, friendly, and expert info. Social Security is a lifeline for millions of Americans, providing vital income in retirement, disability, or when a family breadwinner passes away. Getting the most from Social Security takes some savvy—knowing when to claim, understanding work credits, and tracking your earnings history. Let’s jump in with key info, practical tips, and insider insights to make this topic approachable for everyone—from tenth graders to seasoned pros.

Table of Contents

$3,831, $4,018, $5,108 Social Security Payments

Social Security payments of $3,831, $4,018, and $5,108 in October 2025 aren’t everyday figures, but understanding these amounts helps you make smart financial choices. Maximize your benefits by tracking your work credits, choosing your claim date wisely, and staying informed on rules and adjustments. Social Security is a critical piece of the retirement puzzle that provides a reliable income stream for millions. Remember, planning ahead combined with clear knowledge will help you retire on your terms and avoid common pitfalls.

| Feature | Details |

|---|---|

| Payment Amounts | $3,831, $4,018, $5,108 depending on claim timing and work history |

| Average Monthly Benefit (2025) | Around $1,915 per retiree |

| Maximum Taxable Income (2025) | $174,900 |

| Full Retirement Age (FRA) | ~67 years (born after 1960) |

| Early Claim Age | 62 years (reduced benefits) |

| Delayed Claim Age | Up to 70 years (increases benefit by 8% per year delay) |

| Cost-of-Living Adjustment (COLA) | Projected 3.2% increase in 2025 payments |

| Payment Dates October 2025 | October 8, 15, 22 based on birthdate group |

| Official Social Security Website | ssa.gov |

What Do These $3,831, $4,018, $5,108 Social Security Payments Amounts Mean?

Let’s be real—not everyone gets $5,108 a month from Social Security. That big number is the max possible benefit in 2025, reserved for a small group who have played the game just right. To snag those top-dollar Social Security bucks, you need to check off some serious boxes:

How to Qualify for $5,108 Maximum Benefit?

- Worked at least 35 years

- Earned the maximum taxable income each year (cap is $174,900 in 2025)

- Waited until age 70 to claim (delaying means bigger monthly checks)

If you don’t meet those points, don’t sweat it—most retirees get around $1,915 monthly. Still, that’s a solid supplement for over 65 million Americans.

The other amounts, $3,831 and $4,018, reflect benefits for people who claimed somewhat earlier than 70 but after their full retirement age (usually 67). Claiming before FRA (like at 62) results in smaller checks, sometimes up to 30% less.

Types of Social Security Benefits

Social Security isn’t just for retirees. There are different kinds of benefits:

- Retirement Benefits: For those 62 or older with sufficient work credits.

- Disability Insurance (SSDI): For those unable to work due to a qualifying disability.

- Survivor Benefits: Paid to surviving family members of a deceased worker.

Knowing what you qualify for can help you plan better.

Disability and Survivor Benefits Details

Disability benefits, or SSDI, provide income if you’re unable to work because of a medical condition expected to last at least one year or result in death. To qualify, you must have enough work credits and medical proof of disability. The average SSDI amount varies but is typically similar to or less than retirement benefits.

Survivor benefits help families of deceased workers. Widows, widowers, and dependent children may be eligible. The amount depends on the deceased’s earnings, and survivors can claim at various ages, affecting payment sizes.

How Are Social Security Benefits Calculated?

Four big factors come into play:

- Lifetime Earnings: SSA counts your highest 35 years, adjusted for inflation.

- Work Credits: You earn 4 credits per year; 40 credits usually required.

- Age When You Claim: Early claim reduces benefits; full retirement age yields full amount.

- Delayed Retirement Credits: An 8% annual increase for delays past FRA until age 70.

Example:

Joe works 40 years maxing out earnings but claims at 62, getting around $3,000 monthly. Jane waits until 70 and gets the max $5,108.

How to Apply for $3,831, $4,018, $5,108 Social Security Payments?

Applying is easy and can be done:

- Online: Visit ssa.gov for quick applications.

- By phone: Call SSA’s toll-free number.

- In person: At your local Social Security office.

It’s wise to apply 3 months before you want benefits to start to avoid gaps in income. The online portal is user-friendly, allowing you to estimate your benefits before applying, view your earnings history, and update personal information.

Impact of Working While Receiving Benefits

If you work while collecting Social Security before your full retirement age, your benefits may be reduced based on how much you earn.

- In 2025, if you are under FRA and earn more than $21,240, SSA deducts $1 from your benefits for every $2 you earn over this limit.

- The year you reach FRA, the limit is much higher—$56,520, with deductions of $1 for every $3 over the limit until the month you reach FRA.

- After reaching full retirement age, no earnings limit applies, and your benefits are no longer reduced regardless of how much you earn.

This rule encourages you to work while still benefiting from Social Security but penalizes earnings above these thresholds when claiming early.

Common Myths and Misconceptions

- Myth: Social Security will run out soon.

Fact: The trust fund will reduce but not disappear; benefits may reduce moderately after 2035 if no legislative action is taken. The program remains a crucial safety net. - Myth: Social Security is only for old people.

Fact: Social Security supports retirees, disabled workers, survivors, and families. - Myth: You must claim Social Security as soon as you’re eligible.

Fact: Delaying claiming can significantly increase monthly benefits. - Myth: Social Security automatically signs you up when you retire.

Fact: You must apply to start receiving benefits.

Tips for Planning Social Security with Other Retirement Income

Social Security shouldn’t be your only source of retirement income. Here’s how to plan smart:

- Max out contributions to 401(k) or IRA accounts to grow savings tax-advantaged.

- Understand how Social Security income interacts with pension payments or annuities.

- Keep some emergency savings separate from retirement accounts for unexpected costs.

- Consider the tax implications on combined retirement income, including Social Security.

Financial advisors recommend viewing Social Security as part of a diversified retirement income portfolio for long-term stability.

How to Appeal a Denial of Benefits?

If your Social Security application or claim for disability or survivor benefits gets denied:

- Act quickly—generally, you have 60 days to request a reconsideration.

- Gather additional medical evidence, employment records, or legal documents to support your appeal.

- Consult with Social Security advocates, legal aid organizations, or attorneys specializing in Social Security law—they greatly improve your chances.

- Attend all hearings and provide honest, clear testimony.

Many initial denials are reversed on appeal, so persistence pays off.

Avoid Social Security Scams

Social Security scams are on the rise. Protect yourself:

- Never give out your Social Security Number (SSN) to unsolicited callers or emails.

- The SSA will NOT call you demanding payment or personal information.

- Use the official SSA website for all official communications and verifications.

- Report suspicious calls or scams to the Federal Trade Commission (FTC).

Being vigilant keeps your identity and benefits safe.

What Happens if Social Security Trust Fund Runs Out?

According to SSA projections, the Social Security trust fund may be depleted around 2035 if reforms don’t happen. What does this mean?

- Benefits would be cut to about 77% of what’s currently promised.

- Congress can act anytime to adjust taxes, benefits, or retirement age to keep the system solvent.

- Historically, political will has eventually solved funding crises before fund depletion.

- For current and near-term retirees, benefits are safe.

Planning for varied scenarios is wise but don’t panic; Social Security remains a cornerstone of financial security in America.

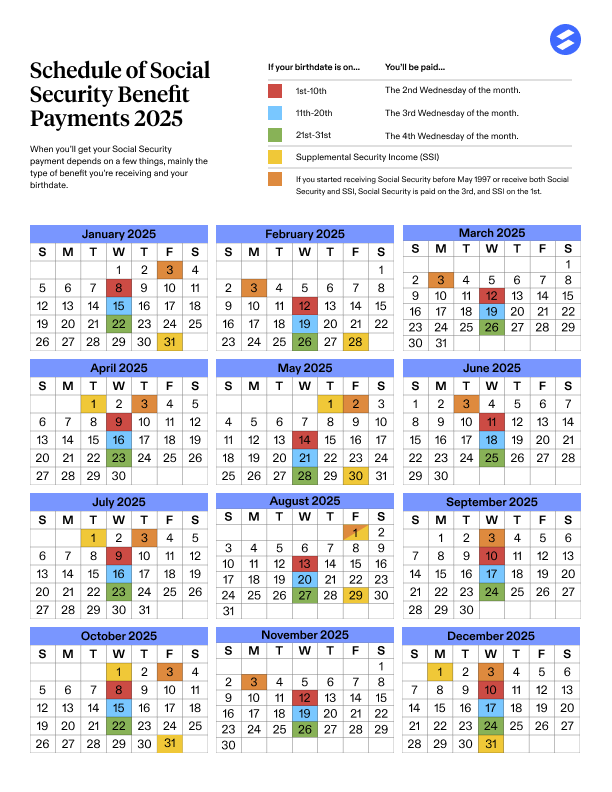

Social Security Payment Schedule for October 2025

Monthly payment dates depend on your birthdate:

- Birthdays 1-10: Payments on October 8, 2025

- Birthdays 11-20: Payments on October 15, 2025

- Birthdays 21-31: Payments on October 22, 2025

Supplemental Security Income (SSI) recipients receive two payments this October—on October 1 and October 31—because of how weekends ding regular payment dates.

Understanding your payment schedule helps with budgeting and financial planning.

$1,976 Social Security Payment Timeline for 62+ Recipients; Check Official Payout Dates

October SSDI and November SSI Payments Scheduled by Social Security for 2025: Check Payment Details!