£300 Pension Blow for UK Retirees: When folks hear “£300 Pension Blow,” it sounds like the UK government is about to snatch hard-earned cash straight out of retirees’ wallets. But while the headline is attention-grabbing, the truth behind HMRC’s October 9 rule change is more layered than it first appears.Starting in April 2026, HM Revenue & Customs (HMRC) will begin reclaiming the £300 Winter Fuel Payment from pensioners with taxable incomes exceeding £35,000. This isn’t a cut to the state pension itself. Instead, it’s a benefit clawback through the tax system, and it’s got millions of retirees across Britain on edge.

This change could impact as many as 2 million pensioners, according to independent estimates. The government frames it as a “fairness measure.” Critics, however, call it a “stealth tax” that undermines a long-standing universal benefit.

Table of Contents

£300 Pension Blow for UK Retirees

The £300 Pension Blow is not a state pension cut — but for millions of retirees, it’s a real and unwelcome change. Starting in April 2026, HMRC will claw back Winter Fuel Payments from pensioners earning above £35,000 annually. This may seem like a small, technical adjustment, but its ripple effects are big. It signals a shift away from universal benefits, introduces stealth means-testing, and adds another financial planning consideration for retirees. Pensioners who are close to the income threshold should act now — review income, check tax codes, seek professional advice, and plan their winter budgets accordingly. This change won’t break everyone’s finances, but it’s one more thing retirees need to stay smart about.

| Category | Details |

|---|---|

| Policy | HMRC Winter Fuel Payment Tax Clawback |

| Effective Date | October 9 (announcement), clawbacks begin April 2026 |

| Who’s Affected | Pensioners with taxable income above £35,000 per year |

| Amount | Up to £300 reclaimed through tax code adjustments |

| Not a Cut | State pension is not reduced – only the Winter Fuel Payment is clawed back |

| Estimated Impact | 2 million pensioners may be affected |

| Government Justification | “Fairness” and targeted support |

| Official Source | HMRC Official Website |

What This “£300 Pension Blow for UK Retirees” Really Means?

The Winter Fuel Payment is a tax-free payment that helps pensioners cover heating costs during the colder months. It was designed as a universal benefit — meaning everyone over state pension age received it, regardless of income.

Under the new rule, pensioners with incomes over £35,000 will still receive the payment in their bank accounts, but HMRC will reclaim it later through the tax system. Essentially, it’s like a short-term loan from the government that gets taken back quietly.

For retirees under that income threshold, nothing changes. For those above it, though, the policy means a smaller net income at the end of the year.

Historical Background: How We Got Here

The Winter Fuel Payment was first introduced in 1997, during a time when energy costs were climbing and older adults were at greater risk of fuel poverty. The logic was simple: no senior should have to choose between heating and eating.

Initially, every eligible pensioner received between £100 and £300, depending on their age and household. For nearly three decades, it was politically untouchable. Governments of both parties promised to protect it because it was popular, simple to administer, and widely seen as fair.

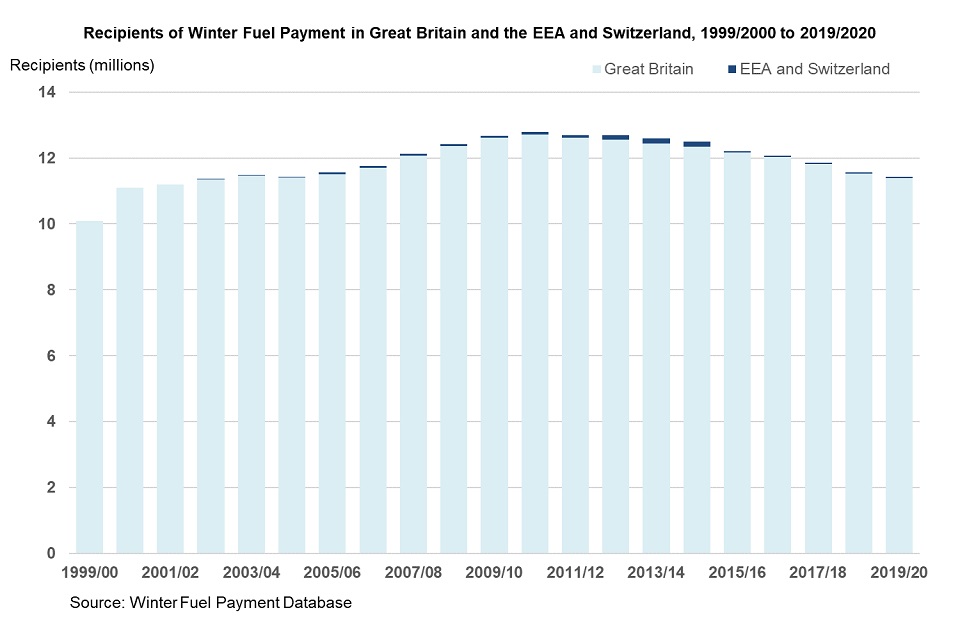

But times have changed. The number of pensioners receiving the payment has grown substantially, reaching nearly 11.4 million recipients in 2023, according to government figures. Combined with rising energy costs and inflation, the annual cost of this benefit is now several billions of pounds.

Faced with increasing pressure on public finances, the government has decided to target the benefit indirectly by reclaiming it from those considered “well-off.”

Why the Change? The Official Justification

The Treasury and HMRC argue that this policy is about “fiscal fairness.” According to their position, pensioners with higher incomes are better placed to manage energy costs without taxpayer support.

This approach mirrors other moves in UK welfare policy, where universal benefits have been quietly means-tested through the tax system rather than outright abolished.

HMRC officials stated in the October briefing that “Winter Fuel Payments will continue to support those most in need, while ensuring taxpayers’ money is used responsibly. Pensioners with higher incomes will still receive the payment, but will contribute back through the tax system.”

The Numbers Behind the Policy

- £35,000 is the fixed income threshold.

- £300 is the maximum amount subject to clawback.

- 2 million retirees are estimated to be affected.

- April 2026 is when the policy takes effect.

- £1.4 billion could be saved over several years, according to policy briefings.

- 11.4 million pensioners currently receive the Winter Fuel Payment.

- The threshold is not indexed to inflation, meaning more pensioners will fall into this bracket over time.

How the Clawback Will Work – Step by Step

- Winter Fuel Payment is paid to pensioners as usual.

- HMRC checks taxable income after the end of the tax year.

- If income exceeds £35,000, HMRC adjusts the tax code.

- The clawback amount is automatically deducted through PAYE or Self Assessment.

- Pensioners won’t need to file a separate claim or repayment — the process is automatic.

For some, the clawback may happen gradually through the tax year. For others, especially those who file tax returns, it could come as a lump sum deduction.

Who Will Feel It the Most?

Not everyone will feel this change in the same way.

- Middle-income pensioners — those just above the threshold — will feel it most sharply.

- Wealthier pensioners may not notice the £300 clawback as significantly, though some view it as a breach of trust.

- Lower-income retirees remain unaffected — for now.

Because the £35,000 threshold is static, even moderate increases in private pension payouts, investment income, or cost-of-living adjustments can push more retirees over the line in future years. What seems like a “targeted” measure today could affect millions more tomorrow.

Public Reaction and Growing Anger

The backlash was swift. Pensioners’ groups, financial forums, and political commentators all criticized the policy for lack of transparency and poor communication.

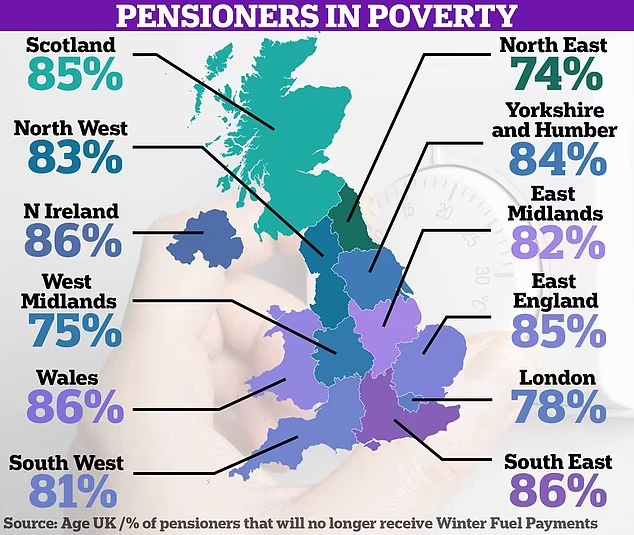

Many retirees feel they have “paid into the system” their whole lives and that this payment was something they earned. Others argue that £35,000 doesn’t make someone rich, especially in parts of the UK with high living costs.

One 72-year-old from Kent told a local paper, “I worked hard all my life, paid every penny of tax, and now they’re coming for my heating allowance. It’s unfair and sneaky.”

Advocacy groups like Age UK and Independent Age have urged the government to reconsider or at least index the threshold to inflation. Without that, they argue, this measure will penalize ordinary pensioners.

Political Ripples

This isn’t just a tax tweak — it’s a political flashpoint. Older voters have long been one of the most influential voting blocs in the UK. Any policy that affects retirees tends to echo loudly in Westminster.

Opposition parties have already seized on the issue, framing it as another broken promise to older Britons. Some backbench MPs from the governing party are uneasy, too. They fear backlash from their constituents, particularly in areas with a large retiree population.

This rule change also fits into a broader shift in government policy:

- Universal benefits are being targeted or reduced.

- Tax thresholds remain frozen, increasing the real tax burden.

- Retirees who once paid little or no tax are now being pulled into the system.

Comparison With Other Pension and Tax Changes

This is not the first time retirees have been hit with indirect tax measures. Over the last few years:

- The personal allowance freeze has pulled more pensioners into paying income tax.

- Reductions in dividend and savings allowances have affected retirees relying on investment income.

- The State Pension Triple Lock, while maintained, has been surrounded by political debate about its affordability.

- Energy support payments have become less universal and more targeted.

The Winter Fuel Payment clawback is the latest addition to this trend.

How to Prepare Financially for £300 Pension Blow for UK Retirees?

Although the change is inevitable for those over the threshold, there are strategies to mitigate its impact.

1. Review Your Total Taxable Income

Go through all sources of income:

- State pension

- Private or occupational pensions

- Investment income

- Savings interest

- Property or rental income

2. Optimize Tax Planning

If you’re just slightly above the £35,000 threshold:

- Consider contributing to ISAs, which are tax-free.

- Explore delaying or restructuring private pension withdrawals.

- Speak to a qualified financial advisor about income-smoothing strategies.

3. Check Tax Codes Regularly

Many pensioners overlook tax code letters. An unnoticed code change can mean unexpected deductions down the line. Review your tax code each year.

4. Budget for Heating Costs

Even if £300 doesn’t make or break your budget, it can help cover energy bills. Plan ahead to avoid surprises next winter.

5. Stay Informed About Policy Changes

This threshold could change after 2026 depending on economic and political pressures. Staying informed means you won’t be caught off guard.

Expert Opinions and Economic Outlook

Dr. Alex Foster, an economist at the London School of Economics, describes this as “a quiet but significant policy shift.” According to Foster:

“Once governments start means-testing universal benefits indirectly, it becomes easier to expand those mechanisms. This won’t stop at Winter Fuel Payments. Over time, more benefits could be clawed back in similar ways.”

Policy experts predict:

- More retirees will be affected as inflation erodes the real value of £35,000.

- Similar clawbacks could be introduced for other benefits.

- Political pressure may eventually force threshold indexation.

Broader Economic Context

This policy lands in a tough economic environment:

- Energy bills remain well above pre-2020 levels.

- Inflation, though easing, has eroded purchasing power, especially for fixed-income households.

- More retirees are relying on private pensions and investment income, pushing them closer to the threshold.

- Public finances remain stretched, prompting governments to target “non-essential” spending.

The £300 clawback might seem modest, but it fits a larger pattern of incremental changes that together reshape the retirement landscape.

DWP Confirms State Pension Changes in 2026 – 5 Crucial Rule Changes Every UK Retiree Must Check

HMRC Confirms £300 Pension Cut from October 9; Every UK Pensioner Needs to Know this, Check Details

UK Two-Child Benefit Cap Changes – Check How It Affects You & Eligibility Rules