$300 Federal Payment in Canada: If you’ve been hearing chatter about a $300 federal payment coming your way around October 25, 2025 in Canada, you might be wondering: “Who’s eligible, how does it work, and what can I expect?” Whether you’re a first-timer navigating government benefits or a finance expert wanting the full scoop, this article breaks down everything you need to know in clear, straightforward language. This one-time $300 federal payment is part of the Canadian government’s ongoing strategy to combat rising inflation and cost-of-living pressures that many Canadians face today. It’s designed to make life just a little easier by offering direct financial support, especially for low- and middle-income households.

Table of Contents

$300 Federal Payment in Canada

The $300 federal payment being disbursed in Canada on October 25, 2025, represents a valuable, timely boost for Canadians navigating the pressures of an increasingly expensive economy. This direct, automatic support reflects the government’s commitment to helping those most affected by inflation and cost-of-living increases. Filing your taxes, keeping your CRA profile updated, and staying informed will ensure you receive this payment without hassle. While not a permanent fix, this payment offers vital breathing room for families and individuals alike.

| Category | Details |

|---|---|

| Payment Name | $300 Federal Payment 2025 |

| Issuing Authority | Canada Revenue Agency (CRA) |

| Deposit Date | Starts October 28, 2025 |

| Eligibility Criteria | Canadian residents with low to middle income who filed 2024 tax returns |

| Payment Method | Direct deposit or mailed cheque |

| Taxable | No, this payment is tax-free |

| Additional Benefits | Recipients might also be eligible for other federal benefits like GST/HST Credit and Canada Child Benefit (CCB) |

| Official Website | Canada Revenue Agency (CRA): https://www.canada.ca/en/revenue-agency.html |

What Is the $300 Federal Payment in Canada?

The $300 federal payment is a targeted financial relief measure introduced to support Canadians who are facing increased costs due to inflation and other economic pressures. This payment acts as a direct infusion of cash into the hands of eligible Canadians to help with immediate expenses such as groceries, gas, rent, and utilities. It is important to note that this is a one-time payment, not an ongoing benefit, aimed to ease financial stress particularly during fall and winter months when expenses often spike.

The Canada Revenue Agency (CRA) administers this payment automatically based on the 2024 income tax returns. This means that if you filed your taxes and your income is within the qualifying range, you don’t need to apply separately—the CRA will assess your eligibility and deposit the payment accordingly.

Why Is This Payment Important Now?

The Canadian economy has experienced unsteady inflation rates, with recent reports indicating yearly inflation hovering around 5%, which significantly impacts the cost of living for Canadians. Key expense categories such as food prices, electricity, heating, gas, and housing have all seen increases. The $300 payment is part of the government’s broader affordability measures aimed at reducing financial hardship, lowering poverty risks, and supporting consumer spending that fuels the economy.

By providing this payment, the government hopes to offer immediate relief and reduce the likelihood that families cut back on essentials or fall into debt due to unforeseen expenses. This payment can also ease concerns around upcoming seasonal costs such as holiday spending or heating bills.

Who Qualifies for the $300 Federal Payment in Canada?

Eligibility for the $300 federal payment hinges on several clear criteria:

- You must be a resident of Canada for tax purposes.

- You should have filed your 2024 income tax return by the deadline.

- Your income must fall within the low to moderate income thresholds as defined by the federal government, which vary based on family size and dependents.

- Those receiving benefits such as the GST/HST credit, Canada Child Benefit (CCB), Guaranteed Income Supplement (GIS), or Canada Workers Benefit (CWB) are generally eligible.

- The payment includes special considerations for students, seniors, single-parent families, and low-income workers who meet the income criteria.

This approach ensures that support goes directly to those who need it most, including vulnerable populations often impacted by rising costs.

How and When Will You Receive Your Payment?

The CRA plans to roll out payments starting October 28, 2025, with distribution continuing over the following days and weeks. There are two main methods of delivery:

- Direct Deposit: The fastest and most secure way to receive the payment. If you have your bank information registered with the CRA, the amount will be transferred directly to your account, typically appearing within 1-2 business days of payment processing.

- Mailed Cheques: If you have not set up direct deposit, the CRA will send you a cheque to your registered postal address. Delivery by mail can take up to 10 business days or longer, especially in remote or rural regions.

The payment will appear as a “Federal Benefit Payment” on your bank statement or in your CRA My Account. It is essential to keep your address and banking information current in your CRA profile to avoid delays.

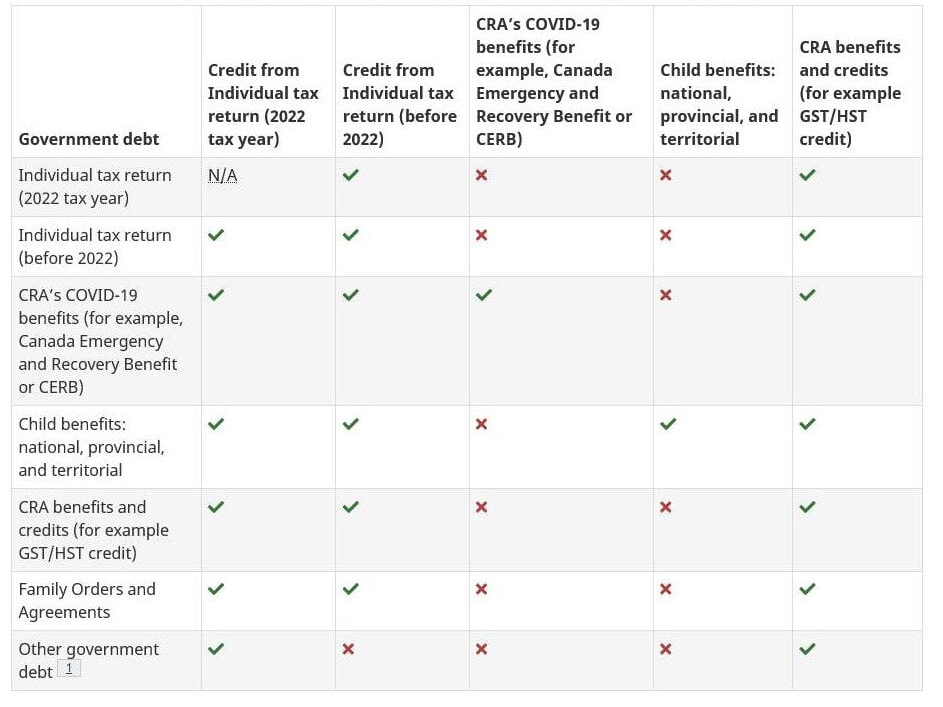

How This Payment Fits with Other Federal Supports?

The $300 federal payment complements a suite of existing government benefits aimed at supporting Canadians:

- GST/HST Credit: Quarterly payments for low and modest-income families to offset sales taxes.

- Canada Child Benefit (CCB): Monthly tax-free payments for families with children.

- Guaranteed Income Supplement (GIS): Additional support for seniors on low incomes.

- Canada Workers Benefit (CWB): A refundable tax credit to supplement earnings.

Unlike some other programs, the $300 payment is a onetime boost, not affecting the amount you receive from other benefits. For those stacked within multiple programs, this can mean a substantial combined support package to help manage household budgets.

Practical Financial Advice for Recipients

If you’re receiving the $300 payment, consider these tips to maximize its benefit:

- Cover Immediate Essentials First: Prioritize payments for groceries, rent, heat, electricity, and essential transportation to ensure day-to-day stability.

- Build or Strengthen an Emergency Fund: Saving even a portion can help soften future financial shocks.

- Avoid New Debt: Use this payment to reduce reliance on credit cards or payday loans that come with high fees.

- Plan Ahead for Seasonal Costs: Use some funds to prepare for winter heating bills or holiday expenses.

- Seek Professional Advice if Needed: Free financial counselling can help you budget this money for long-term security.

Being intentional with this one-time payment can help stretch its value well beyond the amount received.

How to Check Your Eligibility and Payment Status?

Tracking your payment status and confirming eligibility is straightforward:

- Log into your CRA My Account at https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals/account-individuals.html.

- Navigate to “Benefits and Credits” to view upcoming and past payments.

- Ensure your banking and mailing details are up to date to avoid payment issues.

- If you prefer a phone inquiry, CRA offers toll-free support to provide payment information.

- Watch for official CRA emails or mail confirming your payment.

Staying informed ensures you won’t miss this important financial support.

What to Do If You Don’t Receive the $300 Federal Payment in Canada?

- Double-check that you filed your 2024 taxes.

- Verify your bank and address details in CRA My Account.

- Contact the CRA if you suspect any issue with your account.

- Remember, payments are processed over several weeks, so be patient.

- File your taxes promptly if you missed the deadline to qualify for upcoming support.

The Bigger Picture: Economic Impact and Government Support

This $300 payment complements a broader Canadian strategy to provide comprehensive support against economic pressures in 2025. By improving household purchasing power, the government aims to boost economic activity and reduce poverty. The layered distribution of benefits, from child care to seniors’ income supplements, ensures diverse Canadian populations feel supported.

Financial experts see these payments as vital relief mechanisms but caution that longer-term economic challenges require sustainable policy solutions, including affordable housing and wage growth.

Additional Details About Payment Distribution and Timing

The CRA has confirmed a gradual payment rollout to avoid system overload, digital fraud, and ensure proper checks. While some Canadians will see payments immediately, others could experience delays due to address or banking record issues.

Provincial governments also coordinate with the CRA to align complementary benefits such as housing and utility rebates, offering a multi-pronged package of support at the local level.

CPP $1306 Payment Update in November 2025: Check Your Pension Eligibility, Payment Date

CRA Confirms $3900 One-Time Payment – When It’s Coming and Who’s Eligible in Canada

October 2025 Canada Carbon Rebate – How Much You Could Receive? Check Details

Importance of Filing Taxes Timely for Benefit Eligibility

Filing on time remains the single most crucial step to accessing federal benefits like this $300 payment. The CRA has simplified filing processes and offers free services to make tax filing easier. Missing deadlines excludes many from critical financial assistance, underscoring the importance of prompt compliance.

Special Eligibility Notes for Seniors and Students

Seniors collecting Old Age Security and Guaranteed Income Supplement will likely receive this payment automatically if eligible. Meanwhile, students and part-time workers earning below set thresholds will also benefit, highlighting the program’s broad inclusivity.