$2100 Direct Deposit For Canadian Seniors: If you’ve been scrolling through your feed or chatting with friends and saw the buzz about a $2,100 direct deposit for Canadian seniors in 2025, you’re not alone. The internet’s been on fire with claims that every senior will soon see extra cash dropped straight into their bank accounts. But before you picture that payday notification, let’s unpack what’s real, what’s rumor, and what you can actually do right now to make sure you never miss a legitimate government benefit.

$2100 Direct Deposit For Canadian Seniors

The $2,100 direct deposit for Canadian seniors in 2025 remains unconfirmed, though public demand for cost-of-living relief is real and growing. For now, seniors should focus on securing current benefits (OAS, GIS, and provincial programs) and ensure their direct deposit information is up to date. Ignore online rumors, and stay prepared so when real support drops — you’re first in line to receive it.

| Topic | What You Should Know | Source / More Info |

|---|---|---|

| Existing Senior Benefits | Old Age Security (OAS) and Guaranteed Income Supplement (GIS) remain the two main senior programs. | OAS – Canada.ca / GIS – Canada.ca |

| 2025 Adjustments | OAS up 0.7% (Q4 2025) to reflect inflation. | OAS Rates |

| Rumored $2,100 Benefit | Circulating online; not yet confirmed by government or Service Canada. | |

| Payment Dates 2025 | Jan 29 | Feb 26 |

| Verification Tips | Only trust info from Canada.ca or Service Canada — never third-party “claim your payment” links. | Service Canada |

Why Everyone’s Talking About It?

Between higher grocery prices, rent hikes, and utilities that keep creeping up, it’s no wonder Canadian seniors are eager for relief. When you’re living on a fixed income, every dollar counts. So when blogs started shouting “$2,100 for all seniors — automatic!”, folks naturally paid attention.

However, as of now, no official federal statement confirms such a benefit. Still, there’s enough confusion that it’s worth breaking things down clearly — from official OAS and GIS benefits to possible new proposals floating around Parliament.

The Economic Backdrop: Why Relief Is Being Discussed

Let’s be honest — 2024 was tough. Inflation hovered around 3.4%, food prices jumped roughly 5%, and rent rose in most provinces by over 6% according to Statistics Canada. Seniors, especially those on fixed incomes, feel the pinch most.

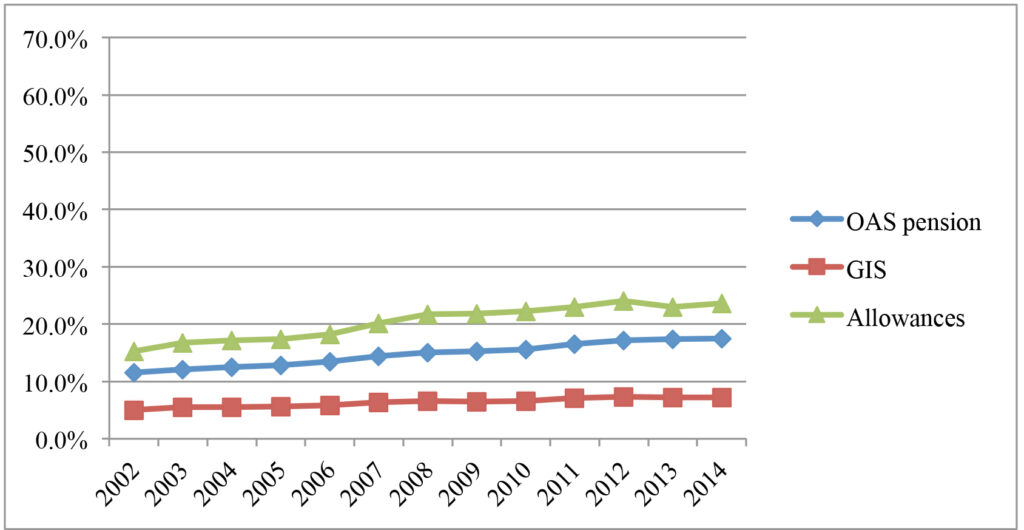

To tackle this, Ottawa has indexed OAS and GIS to inflation quarterly — a good step, but sometimes not enough to offset fast-rising costs. That’s why talks of an extra $2,100 “top-up” sound so appealing: it feels like catching your breath in a high-cost world.

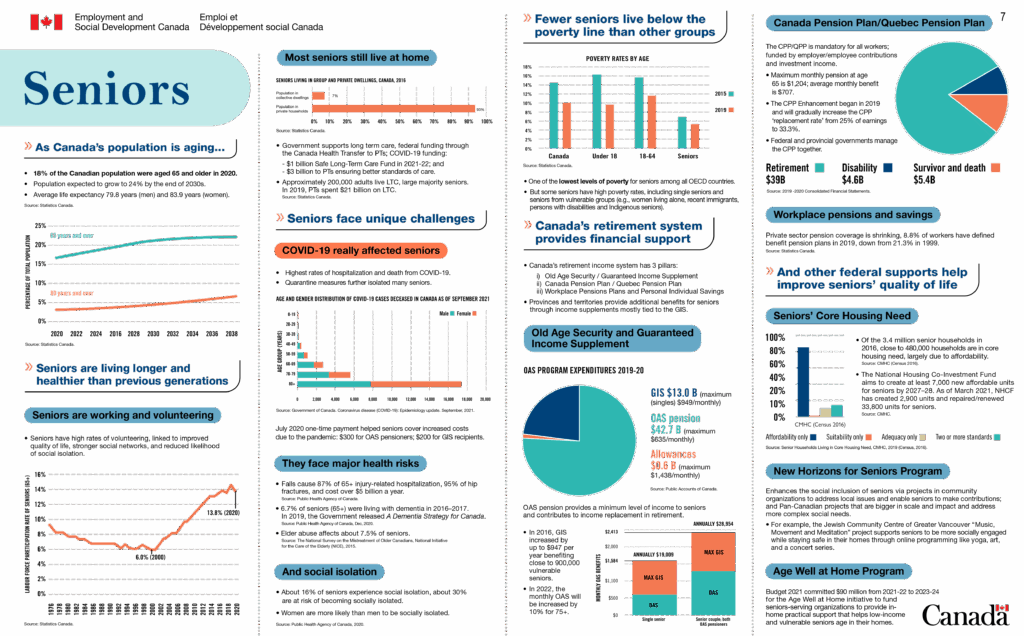

The federal government also knows that seniors represent one of the fastest-growing demographics. By 2030, one in four Canadians will be 65 or older. That means benefit systems must stay sustainable while also responsive to real-life cost pressures.

What’s Real: OAS, GIS, and Other Senior Benefits

1. Old Age Security (OAS)

- Who qualifies: Canadians 65 and older who’ve lived in Canada at least 10 years after turning 18.

- What it pays: $740.09 monthly (ages 65–74) and $815.80 (75 and older).

- Taxable: Yes. Higher earners may face an OAS clawback starting at $93,454 in annual income.

- How to apply: Many Canadians are auto-enrolled, but you can apply through Service Canada.

- Adjustments: OAS adjusts four times a year based on the Consumer Price Index.

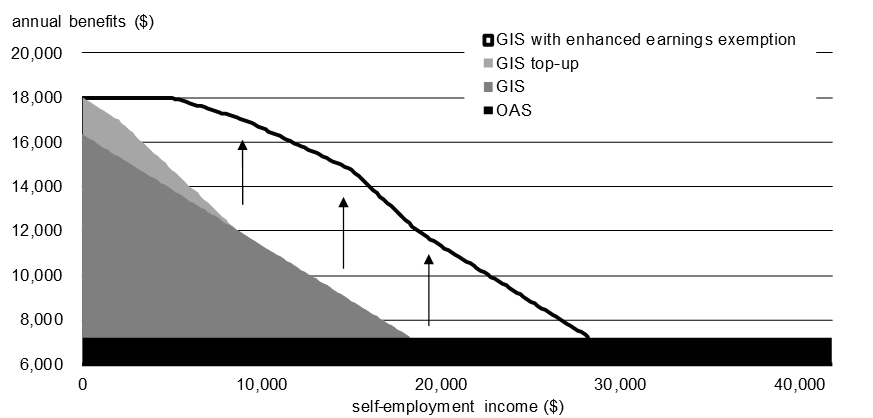

2. Guaranteed Income Supplement (GIS)

- Who qualifies: Low-income seniors who already receive OAS.

- What it pays: Up to $1,105.43/month for a single person, depending on income.

- Tax-free: Yes.

- Renewal: Automatically reviewed each July based on your annual tax return.

3. Allowance & Allowance for the Survivor

For those aged 60–64 with low income whose spouse receives GIS, or widows/widowers under 65 who meet income and residency requirements. Payments range from $1,400 to $1,800 monthly.

These programs form the foundation of Canada’s senior support system, offering guaranteed monthly income and automatic inflation protection.

Why the $2100 Direct Deposit For Canadian Seniors Story Keeps Circulating?

So, where did this rumor start? Some non-official news blogs reported a “one-time senior payment of $2,100–$2,200 in 2025”, claiming it was tied to cost-of-living relief. The problem? None of them linked to official government documentation, and many recycled earlier news about one-time senior payments from 2021.

In 2021, the federal government gave a $500 one-time OAS payment to seniors aged 75 or older, and in 2020, during the COVID-19 pandemic, there was a $300–$500 one-time supplement to help cover pandemic costs. Because of these precedents, Canadians assume a similar top-up might be returning.

There’s also public pressure. Advocacy groups like the Canadian Association of Retired Persons (CARP) have urged the federal government to raise senior benefits amid inflation and housing crises. While no official “$2,100” payment is confirmed, the idea remains politically attractive.

How These Benefits Usually Get Funded?

Federal programs don’t appear overnight. To create a one-time payment like this, the government must follow a strict process:

- Proposal: Cabinet or the Minister of Finance introduces a measure (usually during the federal budget).

- Funding: Treasury Board allocates funds, often billions, depending on the scale.

- Legislation: Parliament debates and passes a bill or includes it in budget implementation acts.

- Administration: Service Canada or the Canada Revenue Agency (CRA) handles payments.

If you don’t see a government budget line item or an official press release on Canada.ca, the payment isn’t real yet.

How to Prepare and Stay Eligible for $2100 Direct Deposit For Canadian Seniors?

Here’s how to make sure you’re positioned to receive any new benefit — confirmed or upcoming.

Step 1: Set Up Direct Deposit

Register for direct deposit through My Service Canada Account or your bank. This ensures you get payments immediately and securely.

Step 2: Keep Filing Taxes

Even if your income is low, file a tax return every year. GIS and other supplements are calculated from your tax data.

Step 3: Track Announcements

Bookmark Canada.ca/news and subscribe to email updates. Government announcements always appear there first.

Step 4: Use the OAS Estimator

The OAS Benefit Estimator shows how much you’re likely to receive. It helps plan monthly budgets and anticipate benefit increases.

Step 5: Verify Before You Share

If someone claims they’ve “already received” a $2,100 payment, ask for a Canada.ca link. If they can’t produce one, it’s likely misinformation.

Expert Insights and Practical Tips

- Rely only on official sources. Benefits are always published on government websites in English and French.

- Stack benefits. Combine OAS + GIS + provincial supports like BC Senior Supplement or Ontario GAINS for maximum coverage.

- Plan for inflation. Use cost-of-living calculators to see how much your income stretches in different provinces.

- Talk to a financial planner. They can help coordinate pensions, RRSP withdrawals, and benefits to reduce taxes.

- Avoid “miracle” benefit websites. If you’re asked to enter personal details or pay to apply, it’s a scam.

Red Flags: Spotting Scams

The rise of online fraud has made seniors easy targets. Common scams include fake “Service Canada” emails promising to “fast-track” your $2,100 payment. Real government representatives will never request your SIN or bank info over email or text.

Signs of a scam include:

- Promises of guaranteed approval

- Requests for a processing fee or payment

- Unofficial-looking URLs (e.g., canadabonus.net)

- Poor spelling or urgent language (“Act now!”).

Comparison to Past Programs

| Year | Program | Payment | Target Group | Notes |

|---|---|---|---|---|

| 2020 | COVID-19 Senior Payment | $300–$500 | All OAS & GIS recipients | Non-taxable, aimed at relief |

| 2021 | OAS 75+ Bonus | $500 | Ages 75+ | Led to permanent 10% OAS increase |

| 2025 (Rumored) | $2,100 One-Time Payment | Unconfirmed | Unknown | Not mentioned in budget yet |

These examples show that one-time supports do happen — but they follow clear budget approval processes, not social media rumors.

Hypothetical Eligibility If It Happens

If Ottawa approves such a payment, it would likely follow these criteria:

- Must be at least 65 years old.

- Must be receiving OAS or GIS.

- Must have a valid Canadian address and SIN.

- Payment would likely be automatic for existing beneficiaries.

- Could be non-taxable, similar to GIS.

The most probable scenario is a one-time cost-of-living top-up issued mid-2025 to offset inflation. But until the federal budget confirms it, there’s no guarantee.

Real-Life Scenarios

Mary, 67 from Ontario, receives both OAS and GIS totaling $1,845 a month. A $2,100 bonus would help her pay utility bills and groceries for two months.

John, 72 from British Columbia, earns $96,000 annually. He faces an OAS clawback and would likely be excluded from income-based relief.

Sara, 64 from Nova Scotia, will turn 65 in November 2025. If the payment targets all new OAS recipients, she might qualify once her application is approved.

Broader Policy Context

Canadian economists often note that senior benefits evolve alongside demographics. According to the Parliamentary Budget Officer, OAS expenditures will reach nearly $100 billion annually by 2030. The government must balance fiscal responsibility with ensuring seniors maintain a decent standard of living.

In recent years, OAS and GIS adjustments have been tied to inflation, but not necessarily to regional living costs. That’s why provinces like Ontario and BC top up federal payments through local supplements.

If the $2,100 proposal ever becomes real, it would likely appear as a federally funded, targeted cost-of-living support, not a permanent benefit.

Canada Housing Benefit $500 Payment in October 2025: Are You Eligible to Get it?

Canada Revenue Agency Dodges Key Question: How Many Call Centre Workers Are Coming?

$400 Increase In CPP/OAS Benefits in October 2025: Who will get this? Check Payment Date

What Professionals and Policy Watchers Should Note

For financial planners, social workers, or policy analysts, understanding these trends is crucial. Benefits like the rumored $2,100 payment reflect public demand for stronger senior support during inflationary times.

Advisors should guide clients to verify benefit eligibility through official channels, maintain compliance with tax filings, and diversify retirement income to reduce reliance on one-off bonuses.

From a macroeconomic lens, such payments boost short-term consumption but must be balanced with long-term fiscal sustainability.