$1,976 Social Security Payment Timeline: Social Security benefits are a crucial financial lifeline for millions of Americans, especially those aged 62 and older. If you’re receiving or planning to receive Social Security payments in 2025, understanding the payment timeline and what to expect with your monthly payout—such as the typical $1,976 payment—is essential. This comprehensive yet easy-to-understand guide breaks down everything you need to know about your Social Security payment dates, special cases for October 2025, eligibility criteria, and tips to help you manage your benefits wisely.

Table of Contents

$1,976 Social Security Payment Timeline

Understanding the Social Security payment timeline for 62+ recipients is essential for budgeting and financial planning in 2025. Whether you’re expecting a typical $1,976 monthly payment or preparing for the unique double payment scenario this October for SSI, staying informed keeps your finances in check. Remember to use official resources like the SSA website and your personal account to verify your payment schedule and amounts. By budgeting wisely, planning for taxes, and knowing your options for when to claim benefits, you can make the most of your Social Security income and maintain financial stability with confidence.

| Topic | Information |

|---|---|

| Typical Payment Amount | $1,976 average monthly Social Security payment for many 62+ recipients |

| Payment Dates in October 2025 | Payments are on Oct 3, 8, 15, and 22; SSI recipients get two payments Oct 1 & 31 |

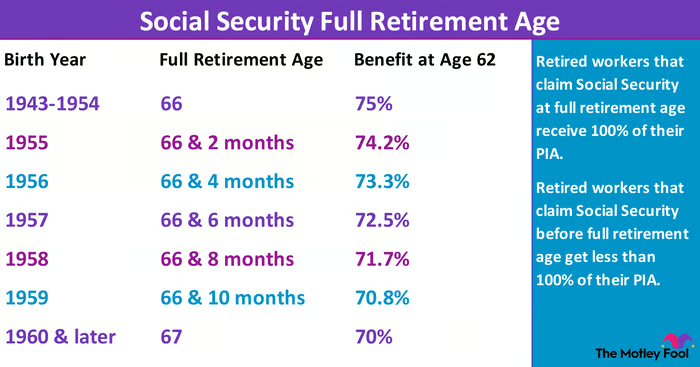

| Eligibility Age | 62 for early retirement; full retirement age varies between 66 and 67 |

| Payment Schedule | 2nd, 3rd, or 4th Wednesday of the month, based on birthdate |

| Special Notes | SSI payment for November moved to Oct 31; no SSI payment in November |

| Where to Verify | Official SSA Payment Calendar |

What Is Social Security and Who Is Eligible at Age 62?

Social Security is a federal program established in 1935 under President Franklin D. Roosevelt to provide financial assistance to retirees, disabled individuals, and survivors of deceased workers. Its primary goal is to ensure Americans have a basic income floor and do not fall into poverty due to retirement, disability, or loss of a family breadwinner.

You become eligible for retirement benefits starting at age 62, but this is considered an early retirement age. Claiming benefits at 62 means you will receive a reduced benefit compared to waiting until your Full Retirement Age (FRA), which ranges from 66 to 67 depending on your birth year. For example, if your full retirement age is 67 and you claim at 62, your monthly benefits are reduced by about 30%. However, some people claim early because they need the income or have health concerns.

Waiting until your FRA—or even delaying benefits until age 70—can result in higher monthly payments due to cost-of-living adjustments and delayed retirement credits. The trade-off is receiving fewer months of payments if you delay.

Understanding the 2025 $1,976 Social Security Payment Timeline for 62+ Recipients

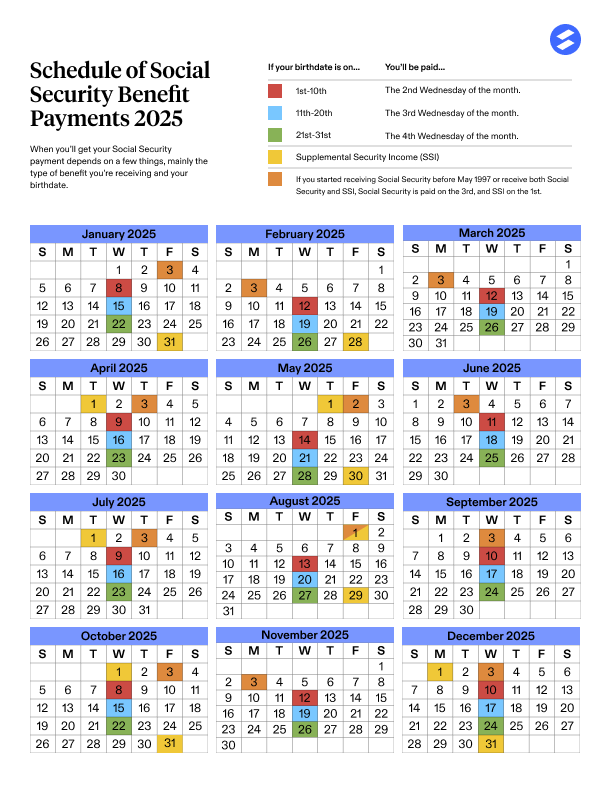

Your Social Security payment is directly related to your birthdate if you started benefits after May 1997. This scheduling system helps spread payments evenly throughout the month:

- Birthdays 1–10: Receive payments on the second Wednesday (October 8, 2025)

- Birthdays 11–20: Paid on the third Wednesday (October 15, 2025)

- Birthdays 21–31: Paid on the fourth Wednesday (October 22, 2025)

If you started receiving benefits before May 1997 or receive both Social Security and Supplemental Security Income (SSI), your payment date most likely falls on the third day of the month, except when it falls on a weekend or holiday, in which case it’s paid early.

This staggered payment schedule ensures banks and the Social Security Administration (SSA) can manage payment processing smoothly.

Why $1,976? What Determines Your Payment Amount?

Your Social Security payment amount isn’t a one-size-fits-all figure—it depends on several factors:

- Your Earnings History: Payments are based on your lifetime earnings where you paid Social Security taxes. The SSA calculates your benefits using your highest 35 years of indexed earnings.

- Age When You Claim Benefits: Claiming earlier than your FRA results in permanent benefit reductions, while delaying increases your monthly benefit.

- Type of Benefit: Retirement, disability, survivor, or SSI benefits have different calculation methods.

- Cost of Living Adjustments (COLA): Benefits are increased annually based on inflation rates to maintain purchasing power.

The approximate $1,976 figure is a typical monthly payment for many individuals qualifying at 62, but the actual amount you receive could be higher or lower depending on your specific situation. The SSA provides personal estimates in your Social Security statement, accessible through your online account.

Special Case: Double SSI Payments in October 2025

In October 2025, SSI recipients face a unique situation. Because November 1 falls on a Saturday, the SSA has advanced the November payment to October 31. This means:

- SSI recipients get their regular October payment on October 1.

- They receive an additional payment on October 31 (the early November payment).

It’s important to understand this is not extra money but rather an early release of the November benefit. Consequently, there will be no SSI payment in November. SSI recipients should budget accordingly to avoid shortfalls.

Types of Social Security Benefits Explained

Social Security benefits extend beyond retirement and vary according to eligibility:

- Retirement Benefits: Paid to workers aged 62 or older who qualify, calculated based on their earnings and age of claim.

- Disability Benefits: For workers under retirement age who are unable to work due to a qualifying disability.

- Survivor Benefits: Given to family members or dependents of a deceased beneficiary or worker.

- Supplemental Security Income (SSI): Needs-based assistance for low-income elderly or disabled individuals with limited work history.

Knowing which category you fall under helps clarify your payment schedule and amounts.

How Cost of Living Adjustment (COLA) Affects Your Benefits?

Each year, the SSA applies a Cost of Living Adjustment (COLA) to benefits based on inflation. This adjustment protects beneficiaries from losing purchasing power due to rising prices. For 2025, there was a significant COLA increase reflecting inflation trends. This means if you received $1,900 a month in 2024, your payment might rise to approximately $1,976 in 2025, depending on your benefit formula.

COLA ensures your Social Security benefits keep pace with the economy, protecting your ability to cover essentials like housing, food, and medical expenses.

How to Check Your Payment Date and Amount?

Taking charge of your Social Security benefits means staying on top of your payment schedule and amount. Here’s how:

- Create or access your My Social Security account:

Visit https://www.ssa.gov/myaccount/ for secure access to your personalized information. - Review your annual Social Security statement:

This statement shows your earnings record and projected benefits at different claiming ages. - Consult the SSA official payment calendar:

The calendar linked here details payout dates for every month and benefit type. - Keep your banking information current:

Update direct deposit details to avoid delays.

How Social Security Payments Are Made?

As of recent years, the SSA no longer issues paper checks. Payments are made through:

- Direct deposit to your bank or credit union account—the safest and fastest way.

- The Direct Express debit card for those without bank accounts, issued by the US Treasury.

This ensures faster, more secure access to funds and reduces mailing delays or lost checks.

Practical Tips for Managing Your Social Security Payments

- Mark your calendar with your specific payment date based on your birthdate or benefit type.

- For SSI recipients, prepare a budget for the two October payments and no November check.

- Use direct deposit or Direct Express to avoid payment delays or theft.

- In case of payment issues, contact the Social Security Administration at 1-800-772-1213 without hesitation.

- Keep your contact and financial info up to date with the SSA.

- Remember, Social Security benefits may be taxable depending on your other income.

Impact of Claiming Benefits Early Versus Waiting

While some folks jump at the chance to get benefits at 62, it’s good to understand the trade-offs:

- Claiming at 62: Smaller monthly payments but you get money earlier.

- Full Retirement Age (66–67): Receive your full calculated benefit without reductions.

- Delaying to 70: Get a bigger monthly check thanks to delayed retirement credits.

Deciding when to claim depends on health, lifestyle, financial need, and personal goals.

Common Issues and How to Troubleshoot

- Late or missing payments: Sometimes payments get delayed due to bank holidays or SSA processing errors.

- Payment amount changes: If your benefits change unexpectedly, check if you’ve reported your income correctly or if adjustments like COLA apply.

- Scams: Never share your Social Security number or bank info with unsolicited callers.

Here’s Why So Many Americans Wish They Waited to Claim Their $300 Social Security

Senator Reveals Trump’s Secret Plan to Slash Tariffs for U.S. Vehicle Production

Trump Just Reinstated $187 Million for NYPD; Here’s Why It’s Sparking Major Controversy