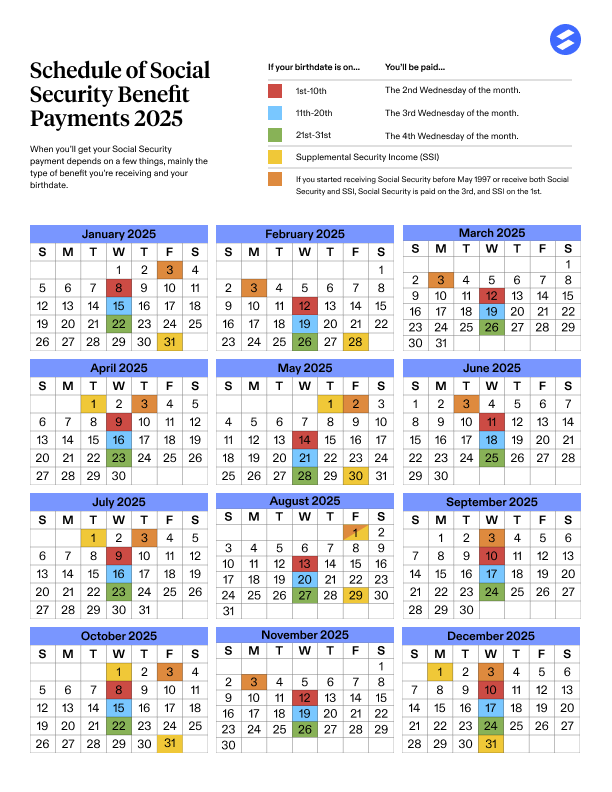

$1,976 Social Security Payments: If you’re 62 or older and rely on Social Security, here’s some important news you don’t wanna miss. Starting this year, your Social Security monthly payment amount has increased to an average of $1,976 thanks to the 2025 Cost of Living Adjustment (COLA). This bump helps your benefits keep pace with rising costs around the country. Now, knowing when you’ll get these payments is just as crucial as knowing how much. This article breaks down the exact dates you can expect your Social Security deposits in November 2025 — presented in a clear, easy-to-understand style, so you can plan your bills and budget accordingly. Whether you’re new to Social Security or a seasoned pro, this guide’s got you covered.

Table of Contents

$1,976 Social Security Payments Soon

The $1,976 average Social Security payment in 2025 is a welcome boost for millions of seniors meeting daily expenses amid inflation. Knowing when you’ll receive your payment based on your birthday is critical for smart money management. Remember the payment dates for October 2025: October 8, 15, or 22 respectively, plus the SSI special early payment on October 31. Understanding Social Security’s ins and outs—from COLA increases to payment methods, eligibility requirements, taxation rules, and scam prevention—empowers you to take charge of your financial future.

| Topic | Details |

|---|---|

| Average monthly payment | $1,976 (Up from $1,927 in 2024) |

| COLA Increase for 2025 | 2.5% |

| Payment Schedule | Based on birthday: |

| Birthdays 1-10: 2nd Wednesday (Oct 8, 2025) | |

| Birthdays 11-20: 3rd Wednesday (Oct 15, 2025) | |

| Birthdays 21-31: 4th Wednesday (Oct 22, 2025) | |

| Supplemental Security Income (SSI) Payments | October 1 & October 31, 2025 |

| Work Credit Requirement | 40 credits required for retirement eligibility |

| Social Security Taxable Income | Up to 85% of benefits may be taxable based on income |

| Official Info Source | Social Security Administration (SSA) Payment Schedule |

What Is Social Security and Why Does It Matter?

Social Security is kind of like the backbone of financial support for millions of Americans aged 62 and above, as well as people with disabilities. It’s a government program where you pay into it during your working years through payroll taxes, and when you hit retirement age or face qualifying disabilities, you start receiving monthly benefits to help with everyday expenses.

Think rent, groceries, healthcare, and bills—the stuff you gotta pay, no matter what. That’s why the government toes the line to adjust your payments using the Cost of Living Adjustment (COLA), ensuring your money keeps up with inflation and rising costs of goods and services. In 2025, the COLA is set to 2.5%, meaning your monthly check gets a helpful boost to fight off inflation.

How Did the $1,976 Social Security Payments Figure Come About?

Here’s the skinny: The Social Security Administration (SSA) calculates COLA based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). They compare price changes from the third quarter of one year to the same quarter the next year. If prices go up, so do your benefits.

The average monthly Social Security retirement benefit will climb from $1,927 in 2024 to roughly $1,976 in 2025. That’s an extra $49 each month to help keep pace with your rising expenses. It might not sound like a fortune, but when you add it up over the year, it’s a significant help for your budget.

When Will You Get Your October 2025 Social Security Payment?

Unlike a fixed date, your payment depends on your birthday range.

Here’s exactly when you can expect the money in your pocket for October 2025:

| Birthday Range | Payment Date (Wednesday) |

|---|---|

| 1st – 10th | October 8, 2025 |

| 11th – 20th | October 15, 2025 |

| 21st – 31st | October 22, 2025 |

And if you’re receiving Supplemental Security Income (SSI), you actually get two payments in October:

- October 1, 2025 (regular monthly payment)

- October 31, 2025 (early November payment due to November 1 falling on a Saturday)

This early SSI payment is not extra money — just a calendar quirk to ensure you have your benefits on time.

Different Ways to Receive $1,976 Social Security Payments

As of now, paper checks are a thing of the past. All Social Security payments are delivered electronically to keep things secure and speedy.

You’ll typically get your money through:

- Direct Deposit – The fastest and safest method, directly into your checking or savings account.

- Direct Express Card – If you don’t have a bank account, you can get payments on this government-sponsored prepaid debit card.

- Electronic Transfer Account – This is a low-cost, federally insured account allowing automatic deposits.

Always double-check your bank details with SSA to avoid any hiccups in receiving your payment.

How Social Security Payments Are Calculated?

It’s good to know what goes into your Social Security check:

- Your monthly benefit is based on your average indexed monthly earnings (AIME), calculated from your top 35 earning years.

- The SSA adjusts for inflation to keep your benefits protected.

- If you delay claiming benefits past full retirement age, you earn delayed retirement credits, boosting your payments up till age 70.

- Your payments can also vary based on spousal benefits, disability status, and survivor benefits.

Eligibility Requirements: How to Qualify for Social Security Benefits in 2025

To receive retirement benefits, you generally need to have earned 40 work credits through paying Social Security taxes during your career. In 2025, earning one credit requires $1,810 in wages or self-employment income, with a maximum of 4 credits available per year. That means you must earn at least $7,240 annually to gain the full credits for that year.

For disability benefits (SSDI), the SSA considers recent work history and age at onset of disability, with different credit requirements depending on your age. For example, younger workers may need fewer credits, while older workers need up to 40 credits.

Supplemental Security Income (SSI) eligibility differs as it is based on limited income and resources, targeting seniors 65 and older, the blind, or disabled persons with financial need.

Can You Work While Receiving Social Security?

Good news for those who want to keep the hustle going: you can work while receiving Social Security benefits. But, watch out for the earnings limits if you claim before your full retirement age (FRA).

- If you’re under FRA and make over $21,240 in 2025, SSA deducts $1 benefit for every $2 earned above that amount.

- The year you reach FRA, the limit rises to $56,520 with a $1 deduction for every $3 earned over the limit (only counting earnings before the month you reach FRA).

- After reaching FRA, you can earn unlimited income without benefit reduction, and SSA recalculates your payments to include previously withheld amounts.

This means you can supplement your income without losing your Social Security after full retirement age.

Are Social Security Benefits Taxable?

You might be surprised: Social Security benefits can be subject to federal income taxes depending on your total income.

Here’s a quick breakdown:

- If your combined income (adjusted gross income + nontaxable interest + half your Social Security benefits) is:

- Below $25,000 (single) or $32,000 (joint), your benefits are usually tax-free.

- Between $25,000 and $34,000 (single) or $32,000 and $44,000 (joint), up to 50% of your benefits may be taxable.

- Above $34,000 (single) or $44,000 (joint), up to 85% of your benefits may be taxable.

Knowing this helps you plan taxes better to avoid surprises.

Protect Yourself: Watch Out for Social Security Scams

Unfortunately, scammers love trying to steal your benefits. Protect your identity and money by remembering:

- SSA will never ask for your full Social Security number, banking info, or payment details by phone, email, or text.

- If you get a call or message claiming to be from SSA asking for sensitive info, don’t share anything—hang up and report it.

- Use your official online mySocialSecurity account to access benefits info securely.

- Regularly monitor your statements and credit reports for suspicious activity.

Why Timing Your Benefits Matters?

Choosing when to claim your Social Security can impact your total lifetime payments. You can start as early as 62, but your monthly check will be smaller to account for longer payment period.

Waiting until your full retirement age (FRA) or even up to age 70 can increase your monthly payment. It’s like betting on yourself to live longer and collect bigger checks.

Factors like marital status affect spousal and survivor benefits, which can also influence your claiming strategy.

Tips for Managing Your $1,976 Social Security Payments

- Keep an eye on the SSA payment schedule. Knowing your exact payment day helps with budgeting and bill payments.

- Opt for direct deposit if you haven’t already—it’s secure and fast.

- Check your mySocialSecurity account regularly for updates on benefits, payment notices, and tax information.

- Review your earnings record annually to make sure your benefits are calculated correctly.

- Plan retirement timing smartly— consider working with a financial advisor to maximize benefits.

- Stay informed about scams and protect your personal info vigilantly.

Social Security Payments Delayed: Here’s Why You Won’t Get Yours Today

Social Security 2026 COLA Forecast: How Much Will Your Benefits Increase?

$3,831, $4,018, $5,108 Social Security Payments in October 2025; How to Get it? Check Eligibility