Reports of an upcoming $1800 stimulus check for American residents have circulated widely in recent weeks, but the claim is misleading. The payment in question applies only to Alaska residents under the state’s Permanent Fund Dividend (PFD) program — a longstanding initiative that shares oil-revenue earnings with eligible residents. The amount, averaging $1702 per person in 2025, is not a federal stimulus payment but a state dividend distribution tied to Alaska’s resource wealth.

Table of Contents

$1800 Stimulus Checks

| Key Fact | Detail |

|---|---|

| Payment Type | Alaska Permanent Fund Dividend (PFD), not a federal stimulus |

| Payment Amount (2025) | Approximately $1,702 |

| Eligibility | Full-year Alaska residency, no felony incarceration, physical presence |

| Funding Source | Investment earnings from Alaska’s oil and gas revenues |

| Official Website | Alaska.gov |

The Alaska model may continue to inspire national conversations about guaranteed income and sustainable wealth-sharing. For now, however, Alaskans can look forward to another year of dividends — a testament to the state’s enduring experiment in shared prosperity.

Understanding the Alaska Dividend Program

The Permanent Fund Dividend was established in 1976 after voters approved a constitutional amendment to set aside at least 25 percent of oil and mineral royalties into a sovereign wealth fund. The fund’s purpose was to ensure that future generations would benefit from the state’s finite natural resources.

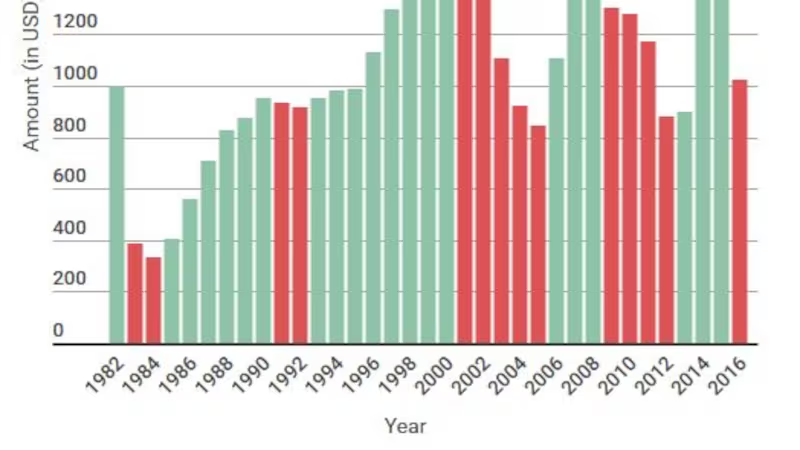

Each year since 1982, eligible Alaskans have received a direct payment based on the fund’s investment earnings. The amount fluctuates with oil prices, market performance, and legislative appropriations.

In 2025, the PFD payment is approximately $1,702 per person, an amount that many headlines rounded to $1,800, sparking confusion about a supposed “new stimulus check.”

“The Alaska dividend isn’t a stimulus in the traditional sense,” said Dr. Carla Peterson, a public-finance expert at the University of Alaska Anchorage. “It’s a predictable, annual distribution — a product of state resource management, not economic relief policy.”

What Makes Alaska Unique?

A Model of Resource-Based Citizen Dividends

Alaska remains the only U.S. state that directly distributes oil revenue to residents. While other states collect resource royalties or severance taxes, Alaska’s Permanent Fund channels a portion of those proceeds into an investment portfolio worth over $80 billion. Earnings from this fund support both the PFD and the state budget.

The dividend’s size is determined annually through a formula combining realized earnings, inflation-proofing provisions, and legislative adjustments. Over the past decade, payments have ranged from $992 to $3,284, depending on market performance and budget policy.

“This program represents a social contract between the state and its citizens,” explained former Alaska Revenue Commissioner Lucinda Mahoney in a 2023 legislative hearing. “It ensures that every Alaskan benefits from the state’s shared natural wealth.”

Eligibility and Requirements

To qualify for the 2025 Alaska Permanent Fund Dividend, applicants must:

- Have been a state resident for the entire 2024 calendar year.

- Intend to remain in Alaska indefinitely.

- Have not claimed residency elsewhere during the qualifying year.

- Not have been incarcerated for a felony or convicted of certain misdemeanors.

- Have maintained physical presence in the state for the required duration (generally 72 consecutive hours for two years).

Applications are accepted annually from January 1 through March 31, and payments are typically issued between September and November.

Individuals who applied by March 31, 2025, and opted for direct deposit are expected to receive their payment in early November, according to the Alaska Department of Revenue.

How the Payment Amount Is Calculated

The Alaska Permanent Fund’s investment earnings are split between two main uses:

- Annual Dividend Payouts to Residents

- Transfers to the State General Fund to support essential services such as education and infrastructure.

The annual payout formula considers 5 percent of the fund’s average market value over the past five years, divided between public spending and citizen dividends.

The Confusion Around “Stimulus” Language

Misleading Headlines

National and social-media outlets often describe the PFD as a “stimulus check” due to its timing, amount, and direct payment format. However, this label is inaccurate. Unlike the federal Economic Impact Payments issued during the COVID-19 pandemic, the PFD is not tied to economic crises, income level, or tax status.

“Stimulus payments are designed to boost economic activity during downturns,” noted Dr. Harold Kim, a fiscal-policy analyst at the Brookings Institution. “Alaska’s dividend, while economically stimulative, is structural and permanent, not cyclical.”

Impact on the State Economy

Despite its non-stimulus nature, the PFD does influence local economic behavior. A 2022 University of Alaska study found that dividend payments boost retail sales by 10–12 percent in the months following distribution. Small businesses often plan inventory and staffing around “dividend season,” which effectively acts as an annual mini-stimulus for the local economy.

However, economists also caution that overreliance on oil revenue and dividend payments can create budget volatility, especially when oil prices fall.

Broader Economic and Social Context

A Case Study in Universal Basic Income (UBI)

The Alaska PFD is frequently cited as an early experiment in universal basic income — a policy concept that provides all citizens with regular, unconditional payments. Scholars and economists worldwide examine Alaska’s model as an example of how wealth redistribution from natural resources can support social welfare and equality.

“The Alaska dividend demonstrates that universal, unconditional payments can be politically durable and socially popular,” said Dr. Philippe Van Parijs, co-founder of the Basic Income Earth Network, in a 2024 interview. “It provides a living laboratory for studying long-term impacts of guaranteed income.”

How Residents Use Their Dividends

Surveys conducted by the Alaska Department of Revenue show that recipients use their PFD funds in diverse ways:

| Category | Percentage of Respondents (approx.) |

|---|---|

| Savings or debt repayment | 30% |

| Everyday household expenses | 28% |

| Travel and recreation | 18% |

| Education or college funds | 12% |

| Investment or business use | 8% |

| Other | 4% |

For many lower-income households, the dividend provides critical relief during the expensive winter months, helping cover heating, fuel, and food costs.

Political Debate and Policy Tension

Balancing the Budget

The size of the PFD has long been a contentious political issue in Alaska. Legislators frequently debate how much of the fund’s earnings should go toward citizen payments versus public services.

In 2019, then-Governor Mike Dunleavy vetoed portions of the state budget to preserve a larger PFD payout, sparking protests and legislative pushback. Lawmakers later reached a compromise formula that stabilized payments but reduced volatility.

“We must maintain the fund’s sustainability while ensuring Alaskans receive their fair share,” Dunleavy said in a 2025 budget statement. “It’s a delicate balance between long-term fiscal responsibility and short-term citizen benefit.”

Long-Term Sustainability

With global oil demand evolving and the energy sector transitioning toward renewables, analysts warn that Alaska’s dependence on oil-linked revenues could limit future PFD growth. Some experts advocate for diversifying investment sources, while others argue the fund should prioritize higher dividends during periods of strong returns.

Federal Context: No New National Stimulus

While Alaska residents can expect their dividend soon, no new federal stimulus checks are planned or approved by Congress or the White House as of October 2025.

The U.S. Treasury and the Internal Revenue Service (IRS) have confirmed that all three rounds of Economic Impact Payments (EIPs) issued during the COVID-19 emergency — totaling up to $3,200 per eligible taxpayer — have concluded. The only remaining federal credit linked to those payments is the Recovery Rebate Credit, claimable through individual tax filings.

Lessons from Alaska

For policymakers and economists, Alaska’s experience offers lessons in resource management, income distribution, and fiscal discipline. While the annual dividend demonstrates the benefits of sharing public wealth, it also underscores the risks of dependency on volatile commodities.

From a citizen perspective, the program reinforces a sense of shared ownership — a tangible connection between individual residents and the state’s natural resources. For others, it provides an informal safety net in a region with high living costs and geographic isolation.

“When you live in rural Alaska, every dollar counts,” said Marie T., a resident of Bethel, in an interview with local broadcaster KTOO. “The dividend might not be a ‘stimulus check,’ but it helps families keep the lights on and the oil tank full.”

October 2025 SNAP Payments: How to Get Your $1,756 on the New Dates

The Smartest Way to Tap Your 401(k) and IRA First in Retirement: Check Details

Why Millions of Retirees May Miss Out on the Full 2026 COLA Increase – Check Details

Looking Ahead

The Alaska Permanent Fund Dividend remains one of the most distinctive economic policies in the United States — blending market investment, public ownership, and social equity. While federal “stimulus” programs have ended, Alaska continues to demonstrate how a state can use natural-resource wealth to support its residents year after year.

Officials have not yet announced the 2026 dividend amount, but early projections suggest payments could remain between $1500 and $1900, depending on oil prices and fund earnings. Residents are advised to check official PFD updates for precise timelines and payment details.