$1,702 Stimulus Payment For Everyone: If you’ve been scrolling through social media and stumbled upon a headline like “$1,702 stimulus payment coming to every American this October!” — pause for a second. It sounds great, right? But before you start budgeting that extra cash, let’s unpack what’s really going on. The truth is, the $1,702 stimulus payment that’s trending across TikTok, YouTube, and Facebook isn’t a nationwide federal stimulus. It’s actually the Alaska Permanent Fund Dividend (PFD) — a yearly payment distributed to eligible residents of Alaska, not everyone in the United States. While the number might look like the COVID-era stimulus checks, the purpose and eligibility for this payment are entirely different. Let’s dive in and explain everything clearly — from what it is, to how it works, and who might actually receive it in 2025.

Table of Contents

$1,702 Stimulus Payment For Everyone

The rumor about a $1,702 stimulus payment for everyone in October 2025 might have started as a misunderstanding, but the truth is clear: it’s not a federal stimulus. It’s Alaska’s Permanent Fund Dividend — a yearly payout for eligible residents funded by the state’s oil and investment income. While most Americans won’t see a $1,702 check this fall, the Alaska PFD stands as a powerful example of how a state can share its natural wealth with its people. If you’re in Alaska, check your eligibility and apply early. If you’re not, keep your eyes open for legitimate programs and remember — when it comes to money, official sources always tell the real story.

| Topic | Details |

|---|---|

| Program Name | Alaska Permanent Fund Dividend (PFD) |

| Rumored Amount | $1,702 |

| Eligibility | Alaska residents meeting residency and legal criteria |

| Payment Month | Expected in October 2025 |

| Administered By | Alaska Department of Revenue |

| Official Website | https://pfd.alaska.gov/ |

| Federal Stimulus? | No – it’s a state-level dividend, not a federal program |

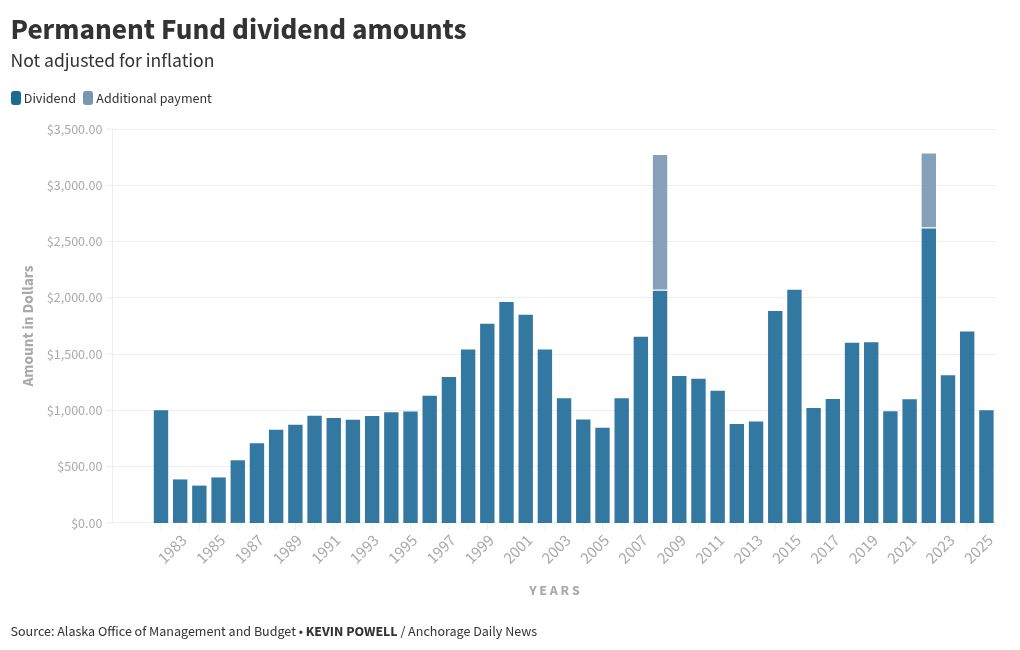

| Average Past Payouts | $992 (2021), $3,284 (2022), $1,312 (2023) |

| Tax Status | Taxable federally, not taxed by Alaska |

| Application Window | January 1 to March 31 annually |

Understanding the $1,702 Stimulus Payment For Everyone

To set the record straight — the Alaska Permanent Fund Dividend is not a stimulus check. It’s a unique, state-funded program that rewards Alaskans with a share of the state’s oil and gas revenues.

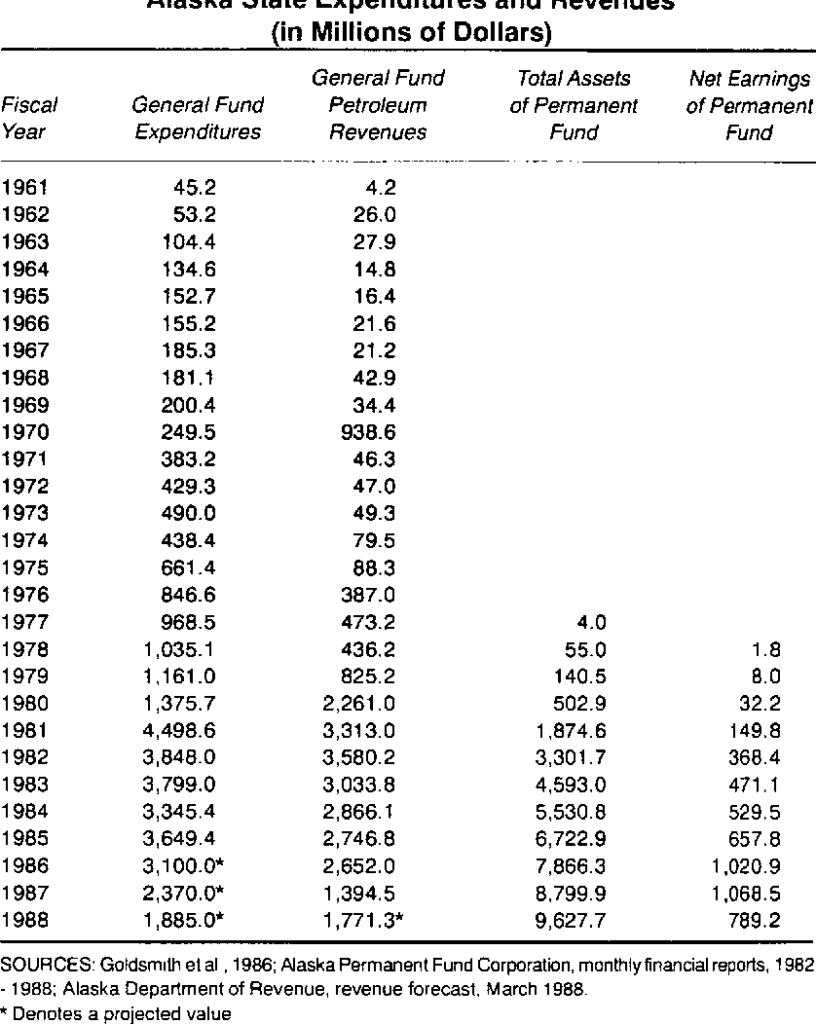

Established in 1976, the Alaska Permanent Fund was designed to ensure that profits from the state’s natural resources benefit current and future generations. The fund invests part of Alaska’s oil revenue, and each year, a portion of those investment earnings is distributed to residents as a dividend.

In simple terms, the PFD is Alaska’s way of saying, “Thanks for living here and helping build our economy — here’s your share of the state’s success.”

How the PFD Amount Is Calculated?

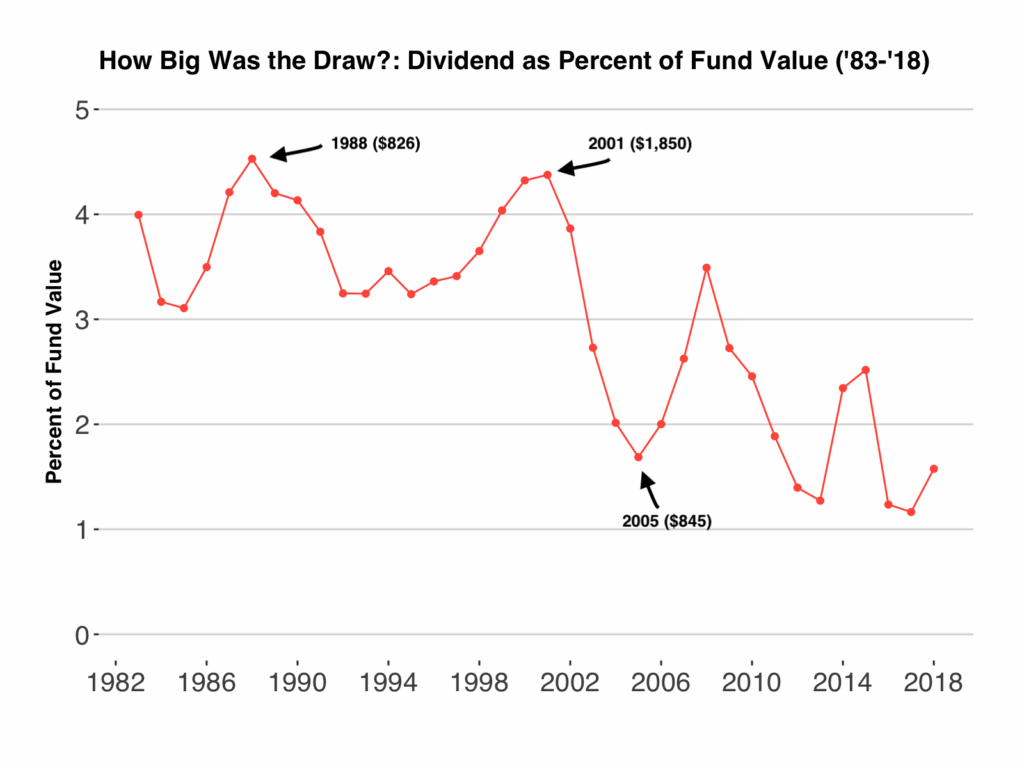

The annual PFD payment isn’t a fixed number. The amount — like the rumored $1,702 for 2025 — depends on how well the fund’s investments perform and how much income the state chooses to distribute.

Here’s how it typically works:

- Fund Earnings: The Alaska Permanent Fund invests in stocks, bonds, real estate, and other assets.

- Statutory Formula: The state calculates 5% of the average market value of the fund from the previous five years.

- Dividends and Budget: A portion goes to the state budget, and another portion goes to eligible residents.

- Legislative Decision: The Alaska legislature and the governor determine the exact payout amount annually.

For example, in 2022, due to high oil prices and investment gains, the PFD reached $3,284 — one of the largest in history. In 2023, it was $1,312, reflecting a lower revenue year. That’s why the 2025 estimate of $1,702 is realistic but not final until confirmed officially by the Alaska Department of Revenue.

Who Is Eligible for the 2025 PFD Payment?

To qualify for the Alaska PFD, residents must meet all the eligibility criteria outlined by the Alaska Department of Revenue. Here’s a breakdown of the key requirements:

- Permanent Residency: You must have been a legal Alaska resident for the entire previous calendar year.

- Intent to Remain: You must intend to remain in Alaska indefinitely.

- Limited Absences: You can’t be absent from Alaska for more than 180 days unless you’re away for military service, education, or other approved reasons.

- No Felony Convictions: Individuals convicted of certain felonies or incarcerated for most of the year are not eligible.

- Application Period: Applications must be submitted between January 1 and March 31, 2025. Late applications are not accepted.

Example:

If Jane moved to Alaska in June 2023 and applied in early 2025, she would not be eligible because she didn’t live in the state for the full 2024 calendar year. However, if she maintains her residency, she’ll be eligible the following year.

Why the Internet Is Calling It a “Stimulus”

Here’s where the misunderstanding begins.

When online blogs and social media influencers spotted that Alaska’s projected payout was $1,702, they started calling it a “stimulus payment”. The term stuck — even though this payment has nothing to do with federal stimulus programs from the IRS or Congress.

Federal stimulus checks — like those issued in 2020 and 2021 — came directly from the U.S. Treasury as part of pandemic relief efforts. The Alaska PFD, however, is state-managed and funded from oil revenue investments.

The IRS has made no announcement of a nationwide payment for 2025.

PFD vs. Federal Stimulus: Key Differences

| Feature | Federal Stimulus | Alaska PFD |

|---|---|---|

| Who Receives It | Eligible U.S. taxpayers | Alaska residents only |

| Source of Funds | Federal government | Alaska’s oil revenue investments |

| Purpose | Economic relief | Resource wealth sharing |

| Application | Usually automatic via IRS | Manual application through state portal |

| Frequency | Temporary (COVID relief) | Annual |

| Tax Status | Taxable income | Federally taxable, no state tax |

Understanding these differences helps prevent scams or false claims. If someone tells you the federal government is sending out a $1,702 check this October — they’re wrong.

How to Apply for the $1,702 Stimulus Payment For Everyone (Step-by-Step)

If you’re a resident of Alaska, applying for the PFD is simple. Here’s how you can do it right:

- Visit the official portal: https://pfd.alaska.gov/

- Create or log into your “myAlaska” account.

- Fill out the online application accurately.

- Submit required documents — ID, residency proof, and any dependent information.

- Double-check before submitting — incomplete or incorrect applications get delayed.

- Submit between January 1 and March 31, 2025.

- Track your application status using the same portal.

Payments are typically distributed in October through direct deposit or paper checks.

The Economic Impact of the PFD

For Alaska, the PFD is more than just free money — it’s an economic stabilizer. According to the Alaska Department of Labor, the PFD contributes over $1 billion annually to the state economy. That money circulates through local businesses, housing markets, and essential services.

A 2023 study from the University of Alaska Anchorage found that roughly 60% of residents use their dividend to pay bills or cover living expenses, while 15% invest or save it. Another 20% spend it locally, stimulating small business growth across the state.

This makes the PFD one of the most effective state-level income redistribution systems in the U.S.

Tax Considerations

Even though Alaska doesn’t impose state income tax, the IRS considers the PFD taxable income.

Here’s what to remember:

- You’ll receive a Form 1099-MISC if you received a PFD payment.

- Report it under “Other Income” on your federal tax return.

- Children who receive a PFD must also report it (or parents must include it on their return).

Practical Ways to Use Your 2025 PFD Payment

If you qualify for the 2025 PFD, consider using it strategically. Many Alaskans treat it as a mini “financial reset.” Here are smart ideas:

- Pay down debt: Eliminate high-interest credit cards or personal loans.

- Save for emergencies: Build a small emergency fund (3–6 months of expenses).

- Invest for the future: Use part of your PFD for an IRA or investment account.

- Cover seasonal costs: Heating, home maintenance, or transportation.

- Support local businesses: Spend locally to keep the money circulating within Alaska.

A disciplined approach ensures that the dividend does more than just disappear after a shopping spree.

Other State Relief Programs in 2025

While the federal government isn’t issuing a new stimulus, a few states are offering localized relief or rebates in 2025:

- California: Middle-Class Tax Refund extensions may continue.

- Colorado: TABOR refund programs expected to send checks in 2025.

- Maine and Vermont: Energy and heating cost relief credits.

- New Mexico: Ongoing income tax rebates for eligible households.

Always verify through official state treasury or revenue department websites before applying.

Cash App $12.5M Settlement Over Spam Text Class Action; You can get $147, Check Eligibility

Here’s Why So Many Americans Wish They Waited to Claim Their $300 Social Security