$1450 SSI Double Payment: If you’ve seen headlines online or on TV saying “$1,450 SSI Double Payment Coming in October 2025”, you might think a big bonus check is on its way. But that’s not exactly what’s happening. This “double payment” isn’t extra money. It’s a calendar quirk in the Social Security Administration’s (SSA) payment schedule that happens occasionally. Because November 1, 2025, falls on a Saturday, the SSA will send November’s Supplemental Security Income (SSI) payment early—on October 31.

That means eligible Americans will receive two SSI payments in October 2025: one at the beginning of the month and one at the end. If you’re already receiving SSI benefits, you won’t need to do anything to get this early payment. But understanding how this works, who qualifies, and how to manage the money wisely is crucial.

Table of Contents

$1450 SSI Double Payment

The $1,450 SSI double payment in October 2025 isn’t a sudden government giveaway. It’s a calendar adjustment—November’s payment landing early because the 1st falls on a weekend. For millions of Americans who rely on SSI, understanding this timing shift is essential. It doesn’t increase your yearly benefits, but it does mean careful budgeting is key to avoid financial gaps in November.

| Topic | Details |

|---|---|

| Event | $1,450 SSI Double Payment in October 2025 |

| Payment Dates | October 1 (October benefit) and October 31 (November benefit) |

| Reason | November 1 falls on a Saturday — payment moved up |

| Amount | $967 (individual) / $1,450 (couple) |

| Eligibility | Age 65+, disabled, blind, or low income |

| Tax Status | SSI is typically non-taxable |

| State Supplements | Some states add extra to federal SSI |

| Official Source | SSA.gov |

| Impact | Early access to funds — no extra money |

How SSI Payment Dates Work?

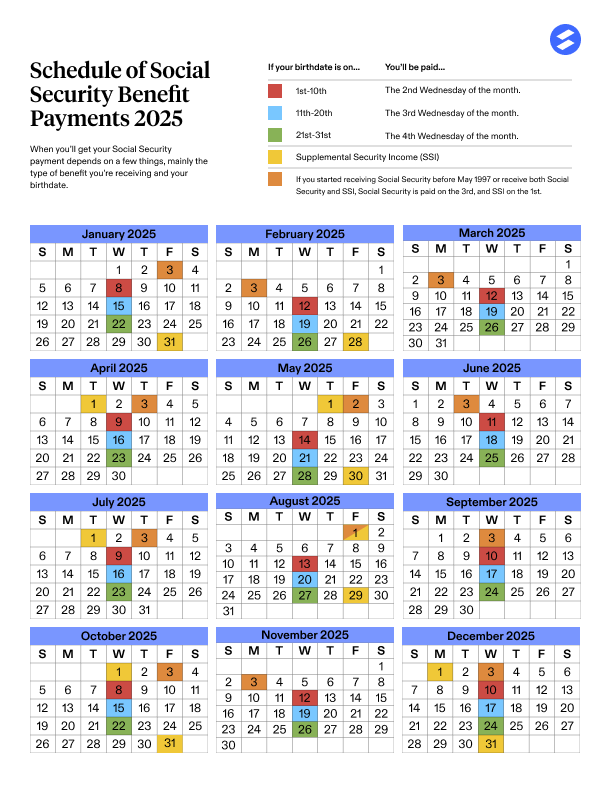

The Social Security Administration (SSA) issues SSI payments on the first day of each month. However, if that date falls on a weekend or federal holiday, the payment is automatically moved to the previous business day.

For October 2025, this means:

- October 1: Regular monthly SSI benefit for October

- October 31: Early payment of the November benefit (because November 1 is a Saturday)

This is why the media refers to it as a “double payment month.” But in reality, the payment that would normally be deposited on November 1 is simply landing in your account on October 31.

This happens regularly throughout the years, but October 2025 stands out because of the larger SSI amounts expected that year due to cost-of-living adjustments.

How Much You’ll Receive?

The federal SSI benefit rate in 2025 is projected to be:

- $967 per month for individuals

- $1,450 per month for eligible couples

This amount can vary based on your income, living situation, and whether your state provides additional supplemental payments.

For example:

- A single person receiving $967 will receive $967 on October 1 and $967 on October 31.

- An eligible couple receiving $1,450 will receive $1,450 on both dates, totaling $2,900 in October.

This early payment is not taxable, and it doesn’t count as extra income for the year. It is simply your November benefit paid in advance.

Why $1450 SSI Double Payment Happen?

This isn’t new or unusual. The SSA makes sure recipients don’t have to wait for benefits if the normal payment day falls on a non-business day.

For example:

- If the 1st of the month is a Saturday, payment goes out on the previous Friday.

- If the 1st falls on a Sunday or holiday, it also goes out earlier.

Because of these rules:

- November 1, 2025, is a Saturday, so November benefits will be paid on October 31.

- December sometimes has similar scheduling when January 1 is a holiday.

This is called a “double payment month” in the benefits community, but the total yearly benefit remains the same.

Historical Context of Double Payments

Double payment months have occurred many times over the years. They are built into the SSA calendar, not sudden policy changes or new programs.

Examples include:

- December 2022, when January 2023’s payment was sent early.

- September 2023, when October’s SSI was paid out early.

- December 2024, when January 2025’s payment is scheduled early.

This means the October 2025 double payment is part of a long-standing SSI system, not a one-time stimulus.

Who Qualifies for SSI?

SSI (Supplemental Security Income) is a needs-based program designed to help individuals with little or no income. To qualify, you must meet specific criteria:

- Be 65 or older, or

- Be blind or disabled, and

- Have limited income and resources

- Be a U.S. citizen or certain qualified noncitizen

- Reside in one of the 50 states, the District of Columbia, or the Northern Mariana Islands.

Resource limits:

- $2,000 or less for individuals

- $3,000 or less for couples

Income limits depend on several factors, including whether you receive other benefits, wages, or financial support.

State Supplemental Payments

In addition to the federal SSI benefit, several states provide extra payments to supplement the monthly amount.

For example:

- California, New York, and a few other states offer some of the highest state supplements.

- Depending on where you live, this could increase your monthly benefit above $1,450 for couples or $967 for individuals.

This means some people may receive a larger total deposit at the end of October 2025, depending on state rules.

Impact of COLA in 2025

The Cost-of-Living Adjustment (COLA) is an important part of Social Security and SSI. It ensures benefits keep pace with inflation. For 2025, COLA is expected to be around 3.2%, though the official number is announced each fall.

This means your October and November payments will reflect any COLA increase. As living costs rise — groceries, gas, healthcare, housing — this adjustment helps recipients keep up with expenses.

How to Manage $1450 SSI Double Payment Wisely?

Receiving two SSI payments in one month can cause confusion or lead to overspending if you’re not careful. Since there will be no payment in November, the key is to plan ahead.

Here are practical steps:

- Create a monthly budget that splits the October 31 payment for use in November.

- Set aside part of the second payment for bills, groceries, and essential costs.

- Avoid making large purchases in October that could leave you short in November.

- Track your expenses carefully, especially if you’re receiving multiple benefits.

- Consider automatic transfers to savings to make sure funds are reserved.

This way, when November arrives without a payment, you’ll still be financially secure.

Effects on Other Benefits and Programs

Receiving your SSI payment early should not reduce your other benefits such as:

- SNAP (food stamps)

- Medicaid

- Housing assistance

- Utility programs

However, some programs review monthly bank deposits, so it’s important to explain that the second October payment is simply November’s SSI paid early.

If you receive other benefits, keep your records clear and contact your benefits advisor if needed.

Tax Implications

SSI is not taxable income for most recipients. Unlike Social Security retirement benefits, SSI is a needs-based program funded through general tax revenues—not payroll taxes.

This means:

- You generally won’t owe federal income tax on SSI payments.

- Receiving two payments in one month doesn’t increase your taxable income.

- You won’t have to file anything special for this double payment month.

Tips for First-Time SSI Recipients

If you’re new to SSI and 2025 is your first year receiving benefits, this double payment may seem confusing. Here’s what to expect:

- Your first payment date will depend on when your claim is approved.

- If you’re eligible before November, you should receive both October 1 and October 31 payments.

- If your benefits begin in November, you may receive only the October 31 payment.

- Setting up direct deposit can help avoid any delays or lost checks.

How to Check Your Payment Dates?

There are several reliable ways to confirm your payment schedule:

- Log into your My Social Security account at ssa.gov/myaccount.

- Call SSA at 1-800-772-1213 for assistance.

- Visit your local Social Security office.

- Check your bank’s direct deposit history.

SSA usually releases the entire payment calendar well in advance, so you can plan your finances with confidence.

Protecting Yourself from Scams

Unfortunately, scammers often use “double payment” announcements to trick people into revealing personal information. Common scams include:

- Fake calls claiming you need to “verify” your information to receive the second payment.

- Texts or emails with fake SSA links promising extra money.

- Impersonation of SSA officials asking for payment or bank details.

Remember:

- SSA will never call or text asking for personal banking info.

- Only trust information from www.ssa.gov.

- Report scams at oig.ssa.gov.

Future Double Payment Months

October 2025 isn’t the only month when this happens. Similar payment shifts are expected in the future. Based on the current calendar, here’s what’s likely:

| Month | Double Payment | Reason |

|---|---|---|

| October 2025 | Yes | November 1 falls on a Saturday |

| December 2025 | Yes | January 1 is a holiday |

| Other months in 2025 | No | Regular schedule |

The SSA will provide the official schedule each year to help beneficiaries plan their budgets accordingly.

$967 SSI Direct Deposit in October 2025; Check Eligibility to claim it, Payment Date

October SSDI and November SSI Payments Scheduled by Social Security for 2025: Check Payment Details!