£11Bn Payout Ahead: If you’ve ever financed a car in the UK, there’s a real chance you might be owed money — serious money. The Financial Conduct Authority (FCA), Britain’s financial watchdog, just announced plans for an £11 billion payout after uncovering widespread car finance mis-selling. Think of it as the car-loan version of the PPI scandal — one of the biggest financial messes in British history. Except this time, the victims aren’t insurance buyers; they’re millions of everyday drivers who may have been quietly overcharged by lenders and dealerships.

Table of Contents

£11Bn Payout Ahead

The £11 billion car finance compensation scheme isn’t just another financial story — it’s a wake-up call about trust in the system. For millions of UK drivers, it’s a chance to reclaim what’s rightfully theirs. For the financial world, it’s a reminder that short-term profits can’t come at the expense of transparency and fairness. As payouts roll out in 2026, the FCA hopes to turn one of the UK’s biggest consumer scandals into a new era of honesty — one where everyone understands what they’re paying for and why.

| Key Facts | Details |

|---|---|

| Regulator | Financial Conduct Authority (FCA) |

| Total Compensation | £11 billion (≈ $13.4 billion USD) |

| Estimated Affected Loans | 14 million car finance deals (2007–2024) |

| Average Consumer Payout | £700 |

| Main Issue | Discretionary Commission Arrangements (DCAs) |

| Consultation Period | October 2025 – March 2026 |

| First Payouts Expected | Mid-2026 |

| Official Reference | FCA Official Website |

Understanding Car Finance Mis-Selling

Car finance sounds simple: pick a car, agree to payments, drive away. But for years, there was a catch buried deep in the fine print — dealers and lenders could secretly raise your interest rate to boost their commission.

This practice, known as Discretionary Commission Arrangements (DCAs), allowed dealers to decide what interest rate you’d pay. The higher they set it, the more they earned.

Imagine buying a £25,000 car. Your dealer quotes you a 9% interest rate, but the lender’s base rate was only 6%. That extra 3% went toward dealer commission — and you never knew. Over a five-year term, that’s an extra £1,200–£2,000 right out of your pocket.

For years, this system flourished under the radar until consumer watchdogs, lawyers, and the FCA finally said: enough is enough.

£11Bn Payout Ahead: Why This Crackdown Matters

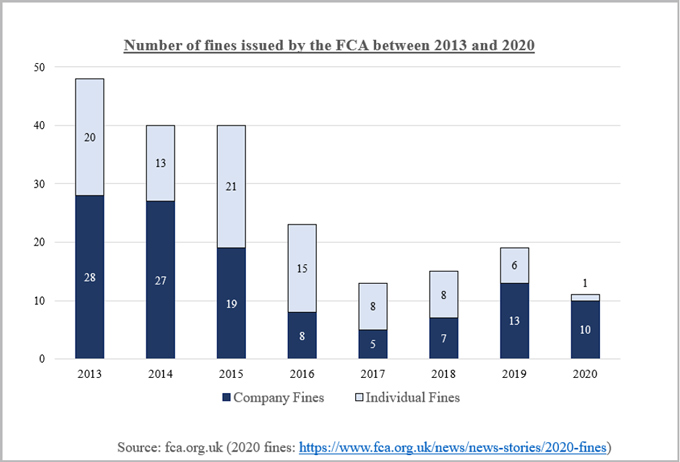

The FCA estimates millions of people were affected. Between 2007 and 2024, almost every major UK lender used commission-based models.

Here’s what the data shows:

- Around 14 million finance deals may qualify for review.

- £8.2 billion is expected to be direct consumer redress.

- The remaining £2.8 billion covers administrative costs and company provisions.

That’s a massive sum — rivaling the early stages of the PPI compensation program, which eventually topped £38 billion.

But this isn’t just about money. It’s about fairness, trust, and transparency in financial services. Ordinary people relied on dealerships and banks to act honestly. Instead, many were charged more simply because they didn’t know better.

How the Scandal Came to Light?

The first red flags popped up years ago. Consumer advocates and the Financial Ombudsman Service (FOS) noticed patterns — borrowers with identical credit scores paying wildly different rates from the same lenders.

In January 2024, the FCA officially launched a probe after thousands of complaints. By mid-2025, it concluded that DCAs were “fundamentally unfair and poorly disclosed.”

That led to a full-blown consultation on a redress scheme — essentially a standardized, nationwide plan to pay back affected drivers.

The consultation began in October 2025 and runs into 2026, aiming to ensure the process is transparent, fast, and fair.

How £11Bn Payout Ahead Impacts Banks and Lenders?

This scheme hits the financial industry right where it hurts — the balance sheet. Big names like Lloyds Banking Group, Barclays, Santander, and Black Horse Finance are already setting aside billions in reserves.

- Lloyds has provisioned roughly £700 million for claims.

- Santander UK expects a similar impact.

- Smaller lenders and independent dealers could face insolvency if claims mount too quickly.

Still, the FCA insists this won’t destabilize the market. Regulators plan to stagger payments and offer flexibility for smaller firms. Their message: consumers come first, but the financial system must stay afloat.

What It Means for Consumers?

This compensation drive could become a lifeline for millions of British households dealing with record inflation and rising living costs. Even a £700 average refund could ease some pressure on struggling families.

In some cases, drivers could receive thousands of pounds back, especially on long-term or high-value car loans.

And here’s the part many people miss — this applies even if your loan is already paid off, as long as it falls within the eligible time frame (April 2007 – November 2024).

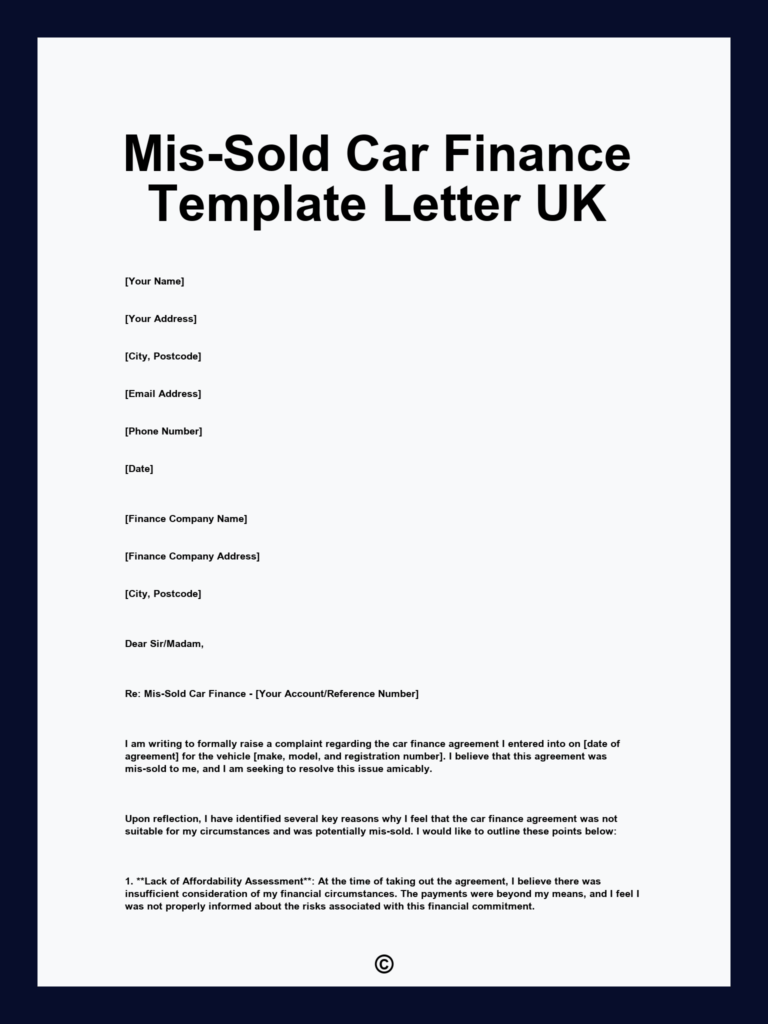

Step-by-Step: How to Check If You’re Affected

1. Find Your Car Finance Agreement

Look for old paperwork, emails, or online banking records. The lender’s name (e.g., Black Horse, Barclays Partner Finance, etc.) will appear on your agreement.

2. Check the Time Frame

If you took out your loan between April 2007 and November 2024, you’re within the eligible window.

3. Wait for the FCA Scheme to Launch

The FCA’s consultation ends in early 2026, and the official claims process will open soon after.

4. Avoid Claims Management Companies (CMCs)

Don’t fall for ads promising quick payouts. CMCs often charge 20%–30% of your refund. You’ll be able to file directly — for free — through official FCA or lender channels.

5. Keep Documentation Handy

When the scheme opens, you’ll need to provide proof of your loan. Keep contracts, emails, and statements ready.

Lessons from the PPI Scandal

Many experts are calling this “PPI 2.0.”

Like PPI, the car finance scandal involves hidden charges and poor disclosure. But this time, the FCA wants to prevent a decade-long saga of legal battles and TV ads.

Instead of individual lawsuits, the FCA is building a centralized claims system, making it faster and easier for people to get refunds.

This proactive stance shows that regulators learned from the PPI experience — faster action, clearer rules, and less red tape.

The Bigger Economic Picture

The UK motor finance industry is huge — worth over £40 billion a year, with millions of consumers relying on credit to buy cars.

When trust in that system breaks down, it ripples across the economy. Fewer people buy cars, dealerships lose sales, manufacturers cut output, and banks tighten lending.

That’s why the FCA is walking a fine line: compensating victims without destabilizing the sector. It’s a balancing act between justice and economic stability.

For investors, it’s a warning: regulatory risk is real. When profit models depend on consumer ignorance, they’re bound to collapse eventually.

Global Implications — Lessons for the U.S.

This isn’t just a UK problem. Across the Atlantic, American regulators like the Consumer Financial Protection Bureau (CFPB) have been watching closely.

U.S. auto finance also relies heavily on dealer markups and discretionary rates. While the CFPB cracked down in 2015, critics say commission bias still exists, especially in used-car markets.

The UK’s redress program could push U.S. lawmakers to revisit their own dealer compensation rules. Transparency isn’t just good ethics — it’s good economics.

The FCA’s Long-Term Strategy

The FCA’s approach isn’t just about payouts — it’s about rebuilding trust. Here’s how they plan to do it:

- Tighter Disclosure Rules: Dealers must now clearly state how commissions are earned.

- Consumer Education Campaigns: Helping drivers understand finance jargon and interest rates.

- Quarterly Reporting: Public progress updates to ensure accountability.

- Digital Claims Platform: A modern online portal to track applications and payouts.

If successful, this could become a model for future redress schemes worldwide.

HMRC Confirms £300 Pension Cut from October 9; Every UK Pensioner Needs to Know this, Check Details

DWP Confirms £416 Monthly Benefit Cut – Urgent Action Required for Thousands of UK Families

UK Seniors Over 60 Could Qualify for a Free Lifetime TV Licence – See If You’re Eligible Today

Expert Insight — A Turning Point for Consumer Finance

From a professional lens, this case highlights why transparency must be baked into every financial product. Hidden commissions distort markets, erode consumer confidence, and hurt long-term profitability.

Economists note that this scandal could accelerate reforms across the UK retail finance sector, pushing for more automation, stricter disclosure, and real-time interest-rate verification for customers.

It’s a shift from “buyer beware” to “industry accountability.”