DWP Confirms £227 Weekly Payment: DWP Confirms £227 Weekly Payment is the headline that’s turning heads across the UK in 2025. From Facebook groups to WhatsApp chats, people are asking: Is it real? Who gets it? When will it start? In this in-depth article, we break down everything — fact vs. rumor — in a clear, conversational, yet expert tone that’s easy to understand and full of credible references.

DWP Confirms £227 Weekly Payment

The headline “DWP Confirms £227 Weekly Payment for These People in 2025” is part truth, part confusion. The number is real — but it refers to the Pension Credit minimum guarantee, not a brand-new benefit. Understanding how the DWP works — and verifying information through official channels — is essential to avoid false hopes or scams. Real support exists — and it’s worth claiming what you’re genuinely entitled to.

| Topic | Current Situation (2025) | What’s Being Claimed / Misunderstood | Official Source |

|---|---|---|---|

| Payment Amount | Pension Credit minimum guarantee: £227.10 per week (single person) | Rumor: New £227/week payment for all benefit claimants | GOV.UK DWP |

| Beneficiaries | Low-income pensioners, certain benefit claimants | Rumor says “millions” of general recipients | Needs confirmation |

| Effective Date | April 2025 (annual uprating) | Claimed as new scheme rollout date | DWP has not confirmed |

| Type of Benefit | Pension Credit / Cost-of-Living Adjustments | Mistakenly seen as new payment scheme | See UK Parliament |

| Verification | DWP, Parliament, HM Treasury | Blogs, news sites without sources | Always confirm on GOV.UK |

Why Is DWP Confirms £227 Weekly Payment claim trending?

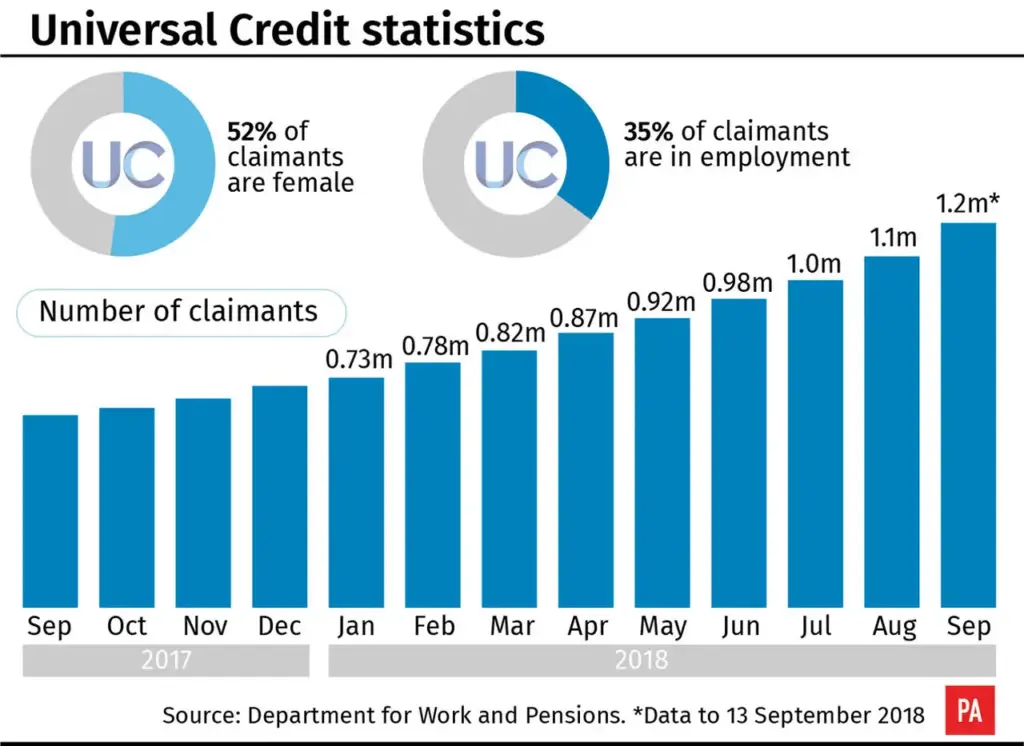

The Department for Work and Pensions (DWP) manages welfare payments in the UK, covering millions of people through programs like Universal Credit, Personal Independence Payment (PIP), Carer’s Allowance, and State Pension. Every year, DWP revises benefit amounts, often in April, to reflect inflation and changes in living costs.

However, the latest online buzz claims that the DWP has confirmed a new £227 weekly payment for eligible citizens starting in 2025. It’s a big number — and naturally, it’s causing confusion.

The truth? As of now, there’s no official confirmation of a new DWP scheme paying everyone £227 a week. But the number does appear in connection with Pension Credit guarantees and could easily be mistaken for a new benefit.

Understanding the context — why £227/week sounds familiar

Let’s get something straight: the figure £227.10/week is not made up. It’s actually the minimum guarantee for single pensioners under the Pension Credit scheme. This ensures that older adults who have little or no income receive a guaranteed weekly income.

For 2025–26, the DWP confirmed:

- Single pensioners: £227.10/week minimum income

- Couples: £347.65/week minimum income

So, while the claim “£227 per week” sounds like a new payment, it’s really the revised minimum threshold for Pension Credit.

This mix-up has caused some bloggers to write headlines like “DWP Confirms £227 Weekly Payment for Millions,” when in fact, it applies to a specific group: low-income pensioners.

Historical trends and policy background

To see how we got here, you need to know how benefits evolve in the UK.

Every year, the government announces “uprating” — adjustments based on inflation or wage growth. In 2025, the DWP announced an average 6.7% rise across most benefits, reflecting the previous year’s Consumer Price Index.

Here’s a snapshot of past increases:

| Year | Average Benefit Increase | Reason |

|---|---|---|

| 2022 | 3.1% | Inflation adjustment post-pandemic |

| 2023 | 10.1% | Cost-of-living crisis |

| 2024 | 6.7% | Inflation-linked rise |

| 2025 | 6.7% (projected) | Wage/inflation balance |

These consistent rises help keep benefits aligned with living costs, but they’re nowhere near the rumored “£227/week for everyone” figure.

Comparing benefit levels — what £227/week really means

Here’s how £227/week stacks up against existing DWP benefits:

| Benefit Type | 2024–25 Weekly Rate | Comment |

|---|---|---|

| Carer’s Allowance | £83.30 | A £227/week payment would be nearly 3× this rate |

| Personal Independence Payment (PIP) – Enhanced | £110.40 | Would still fall short of £227/week |

| Jobseeker’s Allowance (over 25) | £90.50 | £227 would be 2.5× more |

| Universal Credit (standard allowance) | Equivalent to ~£91.50/week | A massive increase if replaced |

| State Pension (new full) | £230.25/week | Almost identical — explains the confusion |

This table shows exactly why the Pension Credit figure of £227/week confuses people — it’s very close to the new State Pension rate, making it easy for rumors to spin off.

Expert insights — what policy analysts say

Economists and social policy experts are skeptical of a brand-new flat-rate £227 payment.

“It’s unlikely that the DWP would roll out a universal £227/week payment beyond pensions,” says Tom Waters, Senior Economist at the Institute for Fiscal Studies (IFS). “The figure closely matches the Pension Credit guarantee, not a new benefit.”

Meanwhile, Age UK emphasized that pensioners should check eligibility:

“Thousands miss out every year simply because they don’t know they qualify. Pension Credit can boost weekly income, and it opens access to other perks like free TV licences and council tax reductions.” (Age UK)

These expert insights show the distinction between rumor and reality — and highlight how easily misinformation can spread when the facts sound similar.

What if a new £227 Weekly Payment actually launched?

Let’s imagine this scheme were real. What would it look like?

Eligibility

- Low-income families earning below a certain threshold

- Unpaid carers providing over 35 hours of care weekly

- Disabled individuals on long-term medical benefits

- People over 66 who don’t receive full pension entitlement

Application process

- Online applications through the GOV.UK benefits portal

- Proof of income, residency, and medical/care status

- Assessment by DWP caseworkers

Payment method

- Weekly direct deposits into registered bank accounts

- Standard notification via letters or digital account updates

- Automatic linkage with National Insurance numbers

Rollout

- Likely in phases: trial regions, then nationwide expansion

- Communication through TV ads, DWP leaflets, and official channels

While this sounds straightforward, implementing such a benefit would be complex and costly. Experts estimate a multi-billion-pound yearly burden, which would require either new taxes or reallocation of funds.

The political and economic angle

A £227/week scheme would be transformative — but politically explosive.

Challenges for the government

- Cost: Covering millions at that rate could exceed £50 billion annually.

- Policy overlap: Would it replace Universal Credit, or stack on top of it?

- Equity: Who qualifies — and who doesn’t?

Potential benefits

- Reducing poverty among working-age adults

- Strengthening safety nets for carers and disabled people

- Boosting consumer spending and local economies

Likely political responses

- Labour Party: Might support under a “Fair Support Framework.”

- Conservatives: Would demand means-testing and spending limits.

- Liberal Democrats/Greens: Would back it as part of universal welfare reform.

Any actual policy of this size would appear in the Autumn Statement or Spring Budget, debated in Parliament, and covered extensively by media like BBC or The Guardian. Since none of that has happened yet, the claim remains speculative.

Red flags and misinformation warning

In the age of social media, it’s easy for misinformation to spread fast. Here’s how to protect yourself:

Red flags:

- Websites with no

.gov.ukor official source links - Posts asking for personal info or “pre-registration” fees

- Conflicting details (some say £227/month, others £227/week)

- No publication date or author transparency

How to verify:

- Go to GOV.UK Newsroom for announcements

- Check Hansard for Parliament mentions

- Look for fact-checkers like Full Fact

- Follow updates from trusted outlets like BBC News, Sky, or The Independent

How to check your eligibility for real benefits?

While £227/week isn’t a new scheme, you might already qualify for other payments:

- Pension Credit – if you’re over State Pension age with low income.

- Personal Independence Payment (PIP) – if you have a long-term health condition or disability.

- Carer’s Allowance – if you care for someone 35+ hours a week.

- Universal Credit – if you’re on a low income or unemployed.

- Attendance Allowance – for pensioners with care needs.

Risks and sustainability concerns

If such a payment ever became official, economists warn of long-term fiscal impacts:

- Higher inflation: More money in circulation could drive prices up.

- Budget strain: Public finances already stretched by cost-of-living payments.

- Reduced labor participation: Some fear it could discourage work participation among low earners.

- Administrative complexity: Introducing a new universal payment system would require IT infrastructure, training, and data coordination across departments.

These realities make it unlikely such a broad payment would be introduced without years of planning.

UK Bus Pass Rules Change from 11th October 2025: Who Still Qualifies?

DWP Confirms £325 Autumn Support Payment in October 2025 – Who will get it? Check Eligibility & Date

The bigger picture — what this means for you

The “£227 weekly DWP payment” story shows how quickly financial misinformation can spread when people are struggling. But it also highlights a truth: the welfare system is evolving, and more targeted support is being introduced every year.

If you’re eligible for Pension Credit, you should apply — not only for the weekly income but for extra perks like:

- Free NHS dental care

- Cold Weather Payments

- Free TV license for over-75s

- Reduced council tax

By not applying, you could be missing out on over £3,000 per year in additional help.