Australia Cost of Living Payment: The talk about the Australia Cost of Living Payment 2026 is heating up. Across the country, people are wondering: Did Centrelink change it? Is a new payment coming next year? With rising grocery bills, rent hikes, and power costs, it’s a fair question. Let’s break down everything you need to know in plain, honest English — from the latest updates and what’s officially confirmed, to expert insights and how to prepare. Whether you’re a pensioner, a young worker, or just trying to keep your finances straight, this guide will make sense of it all.

Australia Cost of Living Payment

In summary, there’s no confirmed “Australia Cost of Living Payment 2026” yet. The original payment ended in 2023, but inflation remains a major issue. While Centrelink’s indexation system continues to adjust payments automatically, new relief measures could appear in upcoming budgets. Experts predict that any 2026 assistance will likely come as targeted rebates, rent assistance, or energy credits, not a blanket handout. Still, Australians should stay informed, budget wisely, and rely only on official government updates. The takeaway? Stay proactive, not panicked. If a new Cost of Living Payment does arrive, you’ll be ready — informed, eligible, and prepared to make it count.

| Topic | What You’ll Learn | Official Source |

|---|---|---|

| Current status | The Cost of Living Payment ended June 2023; no 2026 revival confirmed yet | Services Australia |

| Indexed increases | Centrelink payments rose ~2.4% in July 2025 | SBS News |

| Inflation snapshot | Australia’s CPI sits near 3.5% (ABS March 2025) | ABS CPI Data |

| Expected 2026 relief | Likely focused on rent assistance, energy rebates, and pension boosts | Australian Treasury |

| Financial tips | How to prepare and maximize your Centrelink support | See guide below |

Understanding the Australia Cost of Living Payment

The Cost of Living Payment was a one-off financial support measure from the Australian Government. It was designed to help everyday Aussies — particularly welfare recipients and seniors — manage inflation and rising expenses.

According to Services Australia, the official Cost of Living Payment ended on June 30, 2023. Since then, no new version has been announced for 2026.

Instead, most Australians receiving Centrelink benefits now rely on indexation adjustments — small increases automatically applied to payments twice a year (March and September). These updates aim to keep up with inflation and rising living costs.

So, as of now, there’s no separate Cost of Living Payment 2026, but there are strong indications that targeted relief measures could return under new formats in future budgets.

Why People Are Talking About It?

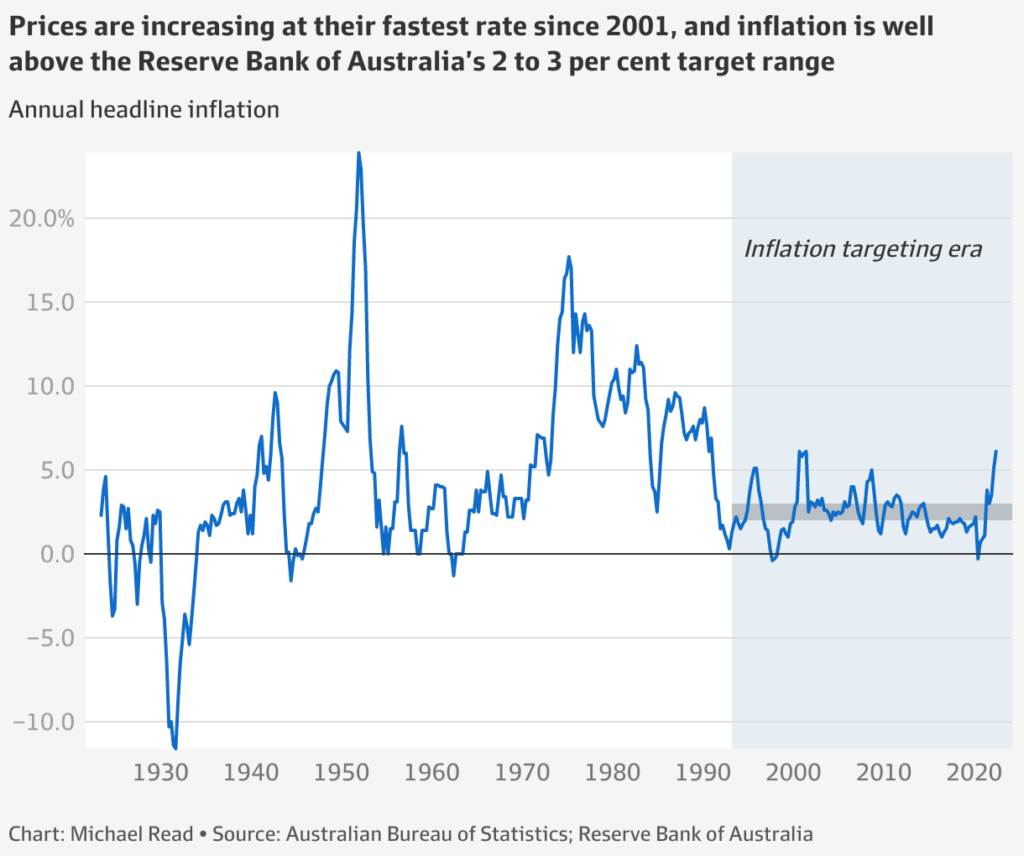

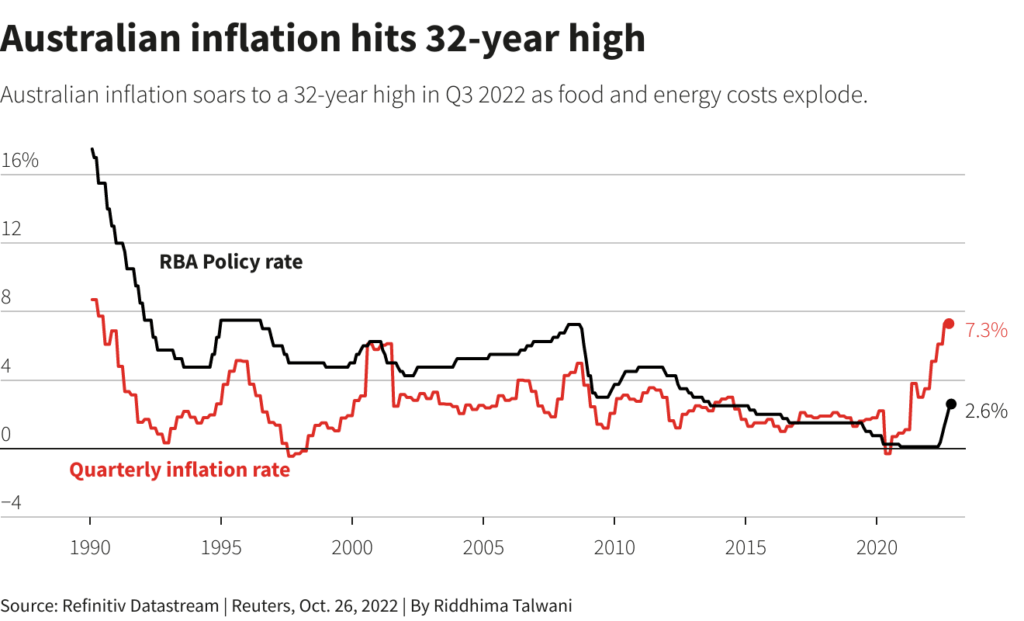

You don’t need to be an economist to know that living costs in Australia are rough right now. The Australian Bureau of Statistics (ABS) reported that, as of March 2025:

- Rent prices have jumped 7% year-on-year

- Food prices are up 4.2%

- Electricity and gas bills climbed 11%

- Household insurance costs rose up to 16%

Those aren’t just numbers — that’s real stress for millions of Australians. It’s why social media and community forums are full of questions about whether the government plans to bring back a 2026 Cost of Living Payment.

Government officials have hinted that future budgets could include “targeted cost-of-living relief” for vulnerable groups. While no official word is out, history shows that during periods of high inflation, extra payments or subsidies often make a comeback.

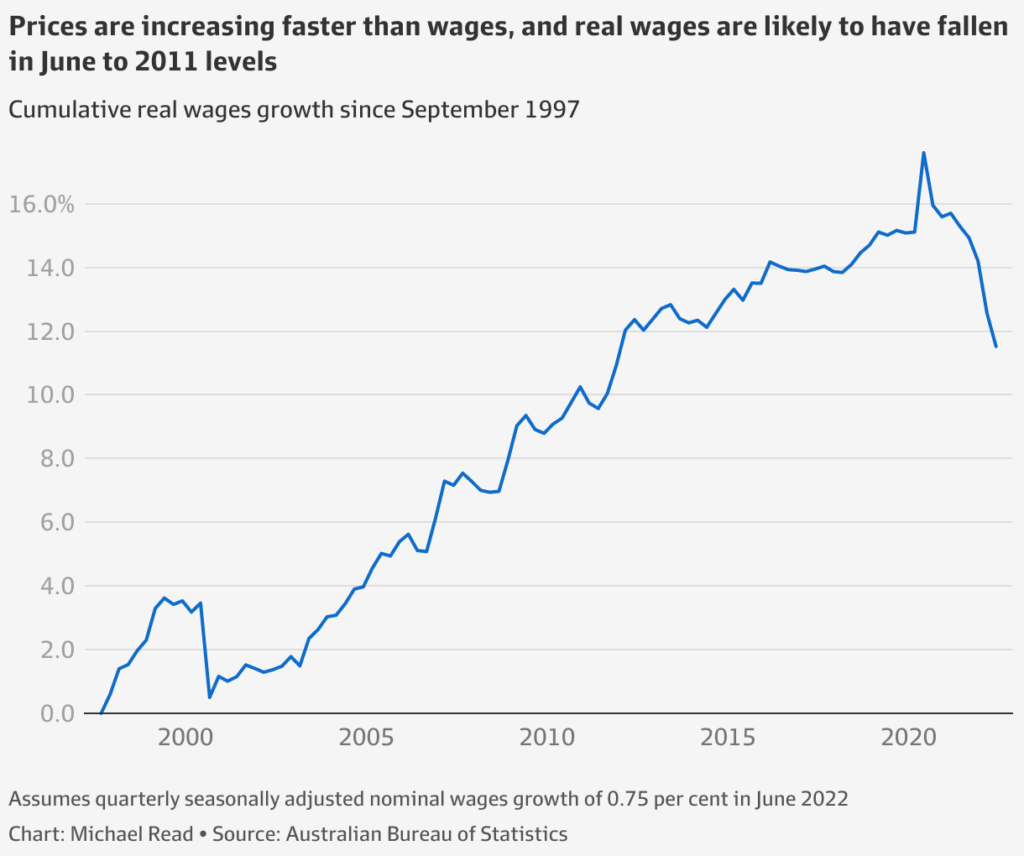

What “Indexation” Really Means?

A lot of people don’t realize that Centrelink payments automatically increase through a process called indexation. This ensures that benefits like the Age Pension, JobSeeker, and Disability Support Pension keep pace with inflation and wage growth.

For example, from July 1, 2025, the following changes took effect:

- Age Pension: Increased by about $19.60 per fortnight for singles

- JobSeeker Payment: Increased by around $13 per fortnight

- Carer and Disability Payments: Adjusted similarly based on CPI

This is the government’s built-in method of easing cost pressures — even if no new payment is introduced. It may not make headlines, but over time, it provides steady, reliable relief.

What a Future Australia Cost of Living Payment Could Look Like?

If the government decides to bring back a Cost of Living Payment in 2026, experts predict it could look quite different from the 2022 or 2023 versions.

Possible Structure

- Targeted Approach: Limited to low-income households, welfare recipients, carers, and pensioners.

- One-Off or Recurring Payment: Likely between $500 and $1,000, depending on budget allocations.

- Automatic Distribution: Sent directly into eligible recipients’ Centrelink accounts.

- Tax-Free Benefit: Excluded from taxable income or income tests.

- Timeframe: Could launch between July–December 2026 if included in the Federal Budget.

Potential Challenges

- Budget Limits: Treasury balancing relief efforts with inflation control.

- Equity Concerns: Determining who qualifies without excluding struggling workers.

- Inflation Feedback: Cash handouts could unintentionally raise demand and prices.

- Delivery Complexity: Administering new payments across millions of accounts efficiently.

Step-by-Step Guide: How to Prepare for Possible 2026 Payments

Even though no payment is confirmed yet, being prepared can help you stay ahead of any changes.

Step 1: Follow Reliable Updates

Keep tabs on official government sites like Services Australia Newsroom and Budget.gov.au. Avoid unverified social media rumors.

Step 2: Review Your Payment Type

Know which Centrelink payment you receive — Age Pension, JobSeeker, Carer, or Disability Support. Eligibility varies across programs.

Step 3: Keep MyGov Details Updated

Check that your bank account, address, and ID details on MyGov are correct to avoid delays in receiving any future payments.

Step 4: Strengthen Your Budget

If costs keep rising, even a small emergency fund helps.

Step 5: Access Free Financial Help

If you’re struggling, the National Debt Helpline (1800 007 007) provides free and confidential financial counselling.

Managing the Cost of Living Right Now

Even without a dedicated 2026 payment, there are many ways Australians can soften the blow of rising expenses.

Energy and Utilities

- Visit Energy Made Easy to compare plans and find better deals.

- Check your state’s website for energy rebates — for example, NSW’s Energy Bill Relief Fund or Victoria’s Power Saving Bonus.

Groceries

- Stick to store brands and bulk buying.

- Use cashback apps like ShopBack or Cashrewards for supermarket purchases.

- Plan meals and avoid impulse buys — small savings stack up fast.

Housing and Rent

- Check whether you’re eligible for Rent Assistance via Centrelink.

- Consider shared accommodation or community housing if rent consumes over 30% of your income.

Transport

- Use fare caps on public transport and fuel comparison apps before filling up.

- If you drive, schedule trips efficiently to save fuel.

Real-Life Examples

Example 1: Olivia, a Pensioner in Victoria

Olivia receives the Age Pension and struggles with electricity bills. If a 2026 Cost of Living Payment were introduced, she would likely receive an automatic deposit — say $750 — directly into her account. That could cover two months of energy bills or a chunk of her rent.

Example 2: Daniel, a JobSeeker Recipient

Daniel works part-time while receiving JobSeeker. If the government sets an income cap for eligibility, his side income might push him above the threshold. It’s important he keeps track of his income reporting to stay eligible for any future payments.

These examples show how eligibility rules can impact everyday Australians differently — which is why staying informed is key.

Expert Opinions and Economic Outlook

Economists from the Grattan Institute and the University of Melbourne suggest that Australia’s next cost-of-living relief measures will likely be targeted rather than universal.

Dr. Danielle Wood, CEO of the Grattan Institute, explained in a recent interview that “targeted payments are more fiscally responsible and ensure that the most vulnerable households receive the greatest benefit.”

Meanwhile, the Reserve Bank of Australia projects that inflation will fall back to around 2.5% by mid-2026, which could influence how generous any new government payments will be.

This means relief is likely to focus on:

- Rent and housing support

- Energy rebates

- Tax offsets or small business concessions

Professional Insight: What You Should Do as an Advisor or Employer

If you’re a financial planner, HR manager, or social service worker, staying ahead of these policy shifts matters. Clients and employees rely on accurate information, and misinformation can spread quickly.

- Educate clients about verified resources and budgeting tools.

- Prepare templates for payment verification and income tracking.

- Watch budget announcements each May for any direct references to “cost of living” adjustments.

Understanding how payments tie into inflation, welfare eligibility, and tax obligations builds trust and professional credibility.