NZ Pension Changes: If you’ve been scrolling through social media or chatting at the local café, you’ve probably heard some buzz about the NZ Pension Changes from October 2025. Rumors of “bigger payments,” “new eligibility rules,” and “KiwiSaver tweaks” are floating around like confetti. But what’s really changing—and when? Let’s get one thing straight: while some tweaks will appear in late 2025, the major shifts come from the April 2025 annual adjustment, which carries through October and beyond. These updates affect how much retirees get paid, when those payments land, and how the KiwiSaver landscape evolves in 2025 and 2026. This guide breaks it all down, step by step, in plain, easy-to-grasp language. Whether you’re 65 and retired, planning ahead for the next few years, or helping your parents navigate their finances, you’ll walk away with clarity and confidence.

NZ Pension Changes

The NZ Pension Changes from October 2025 are part of a broader movement to keep retirement benefits sustainable and aligned with inflation. Though there’s no brand-new policy debut in October itself, the April 2025 adjustments carry forward, delivering higher fortnightly payments, fairer residency rules, and revised KiwiSaver incentives. For most Kiwis, these updates mean steady income, better purchasing power, and clearer long-term planning. The best move? Stay informed, revisit your budget, and treat your pension as a cornerstone—not your entire plan—for financial independence.

| Category | Details (Effective April–October 2025) | Official Source |

|---|---|---|

| New NZ Super Rates (after tax, code M) | Single (living alone): NZD 1,076.84 / fortnightCouple (both qualify): NZD 1,656.68 total (NZD 828.34 each) | Work and Income NZ |

| Payment Dates (October 2025) | Tuesday, Oct 7 and Tuesday, Oct 21 (fortnightly schedule) | Govt.nz |

| Next Annual Adjustment | 1 April 2025 (based on CPI + average wage growth) | |

| Residency Rules | New residency criteria apply from July 2024 for those turning 65 after that date | |

| KiwiSaver Changes | Govt contribution drops to 25¢ per $1 saved (from Jul 2025); higher earners lose top-up | |

| Who Benefits Most | Single retirees, low-income couples, and new KiwiSaver contributors |

What’s Actually Changing in the NZ Pension Changes?

Here’s the truth: despite headlines mentioning “October 2025 pension changes,” the government doesn’t adjust NZ Super in October. Instead, rates are updated every April 1st through the Annual General Adjustment, which keeps payments aligned with inflation and wage growth.

So, the new rates you’ll receive in October 2025 are the same ones that took effect back in April 2025—but they matter because they reflect real gains in purchasing power during a high-cost-of-living period.

This annual bump helps pensioners keep pace with food, fuel, and housing prices that keep climbing across the country. Think of it as a built-in pay raise for retirees, just like the Cost of Living Adjustment (COLA) for U.S. Social Security.

New Payment Rates – How Much Will You Get?

Let’s break down the new NZ Super rates effective April 1 2025 (after tax under code M):

- Single, living alone: NZD 1,076.84 per fortnight

- Single, sharing accommodation: NZD 994.00 per fortnight

- Couple (both qualify): NZD 1,656.68 combined (NZD 828.34 each)

- Couple (only one qualifies): NZD 828.34 for the qualifying partner

That’s roughly NZD 28 more per fortnight than in 2024 for single retirees—small but significant when every dollar counts.

These figures are calculated using Consumer Price Index (CPI) data and the average wage index. The goal is to ensure NZ Super keeps up with real-world price hikes, not just numbers on paper.

If you have another source of income (say, a side job or rental property), your tax code may shift (S, SH, ST, etc.), slightly changing your take-home amount.

When Are Payments Made?

NZ Super and Veteran’s Pensions are paid fortnightly on Tuesdays.

For October 2025, your paydays will be:

- Tuesday, October 7, 2025

- Tuesday, October 21, 2025

If a payment date falls on a public holiday, Work and Income releases the funds early so you’re never left short.

Eligibility – Who Qualifies and Why

To receive NZ Super, you must:

- Be 65 years old or older

- Be a New Zealand citizen or resident

- Have lived in NZ for at least 10 years since age 20, with 5 of those years after age 50

From July 2024, the government tightened residency rules. Anyone turning 65 after that date may need a longer period of residence to qualify. These changes are part of the government’s effort to keep NZ Super sustainable as more people live longer and draw benefits for decades.

If you’ve spent time overseas, some countries (like the U.S., Australia, and U.K.) have social security agreements with New Zealand. That means your foreign pension might offset your NZ Super—no “double dipping.”

The Bigger Picture – Why These NZ Pension Changes Matter

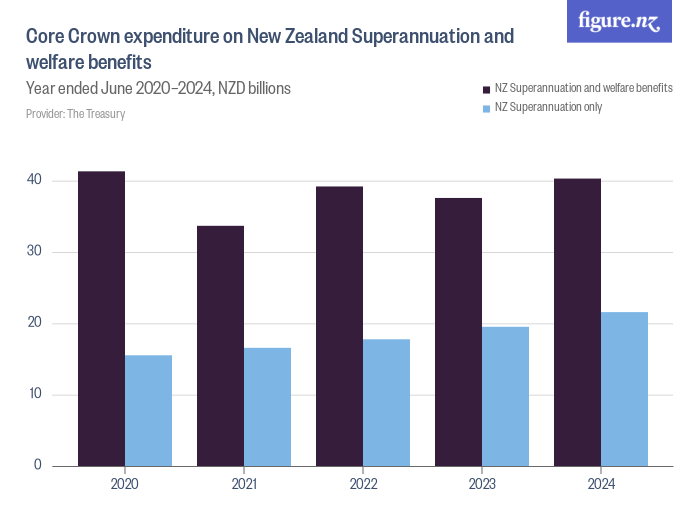

By 2034, one in four Kiwis will be 65 or older, according to Stats NZ. That’s roughly 1.4 million people drawing superannuation. Maintaining fair payments is essential to prevent poverty among older citizens.

The April 2025 adjustments increase average super payments by about 3 %. It’s not a jackpot, but it helps cover everyday costs that keep creeping up—like power, food, and rent. The policy aims to balance economic reality with fiscal responsibility as the country manages its aging population.

In short, these updates help pensioners maintain purchasing power and dignity without politicizing the system.

KiwiSaver and Retirement Savings – Big Changes Coming

Here’s where 2025 gets interesting. While NZ Super rates stay government-funded, KiwiSaver, the voluntary retirement savings scheme, is seeing a policy shake-up:

- From July 1 2025, the government top-up drops from 50¢ to 25¢ for every $1 you contribute (your maximum annual top-up falls from NZD 521 to around NZD 260).

- Individuals earning over NZD 180,000 per year will no longer receive any government contribution.

- Starting April 2026, the minimum mandatory KiwiSaver contribution rate (for both employees and employers) rises from 3 % to 3.5 %, with further increases expected later.

Why does this matter? Because KiwiSaver acts as the second pillar of retirement security. The reduced government bonus means you may need to adjust your own savings plan to hit your retirement goals. If you’re in your 50s or 60s, that slight policy shift could impact your long-term nest egg.

Practical Tips to Make the Most of Your Pension

1. Review Your Budget Every April

Once the new rates kick in, update your monthly budget. Groceries, power bills, and transport costs can creep up faster than you realize. A simple spreadsheet or free budget app like Sorted NZ can keep you on track.

2. Check Eligibility for Extra Support

You might qualify for extras like the Accommodation Supplement, Disability Allowance, or Winter Energy Payment.

3. Keep Working If You Can

There’s no income limit on NZ Super. A part-time job can add both income and purpose to your life — just use the correct tax code to avoid overpaying.

4. Reassess Your KiwiSaver Strategy

With lower government contributions starting in 2025, it’s a good time to review your fund type and contribution rate. Even a 1 % increase in your own savings can mean tens of thousands more by retirement.

5. Use Free Financial Advice Services

Sites like Sorted NZ offer personalized tools to plan retirement, calculate income gaps, and understand how your KiwiSaver works alongside NZ Super.

Comparison: NZ Super vs U.S. Social Security

| Feature | NZ Superannuation | U.S. Social Security |

|---|---|---|

| Eligibility Age | 65 | 67 (for most Americans) |

| Means Tested? | No | Indirectly (via tax on benefits) |

| Funding Source | General tax revenue | Payroll tax (FICA) |

| Payment Frequency | Fortnightly | Monthly |

| Adjustment Method | CPI + Average Wage | COLA (CPI only) |

The concept is similar — a government-funded safety net for retirees — but NZ Super is simpler and paid automatically without a lifetime of payroll contributions.

Expert Perspective: Adapting to an Evolving Retirement Landscape

As financial planner John Matthews puts it:

“NZ Super should be your foundation, not your whole house. It keeps the lights on, but you build the rest of your future with savings and smart choices.”

That mindset matters more than ever. Between inflation, longer lifespans, and changing government policies, retirees must stay flexible. Think of retirement like a puzzle — NZ Super is the corner piece, but you need KiwiSaver, investments, and maybe part-time income to complete the picture.

Financial advisors recommend setting aside a small emergency fund (even $2,000 can cover surprises) and reviewing investment allocations every 12 months. Older investors often shift toward balanced funds to protect against market volatility while keeping some growth potential.