$5000 Wells Fargo Settlement Payment: If you’ve been hearing about the $5,000 Wells Fargo Settlement Payment in 2025, you’re probably wondering if it’s real, if you qualify, and how much you might actually get. The number “$5,000” sounds exciting, right? But, as with most legal settlements, the reality is a bit more complicated. Let’s take a clear, no-nonsense look at what this Wells Fargo settlement really means, who’s eligible, how to file a claim, and what to expect next. This article breaks it down in plain English — with insights from legal experts, verified data, and official resources — so you don’t fall for clickbait or fake claims.

$5000 Wells Fargo Settlement Payment

The $5,000 Wells Fargo Settlement Payment in 2025 is real — but it’s not a get-rich-quick deal. It’s part of a $19.5 million settlement meant to compensate California consumers for having their phone calls recorded without consent. Most people can expect around $86 per eligible call, not thousands. Still, if you received multiple calls, it could add up. To protect your rights and privacy, make sure you file before April 11, 2025, through the official website, and avoid scam links. Whether you’re a consumer, a homeowner, or a finance professional, staying informed about these cases helps keep corporations accountable.

| Topic | Detail | Official Source |

|---|---|---|

| Total Settlement Amount | $19.5 Million | TopClassActions.com |

| Type of Case | Call recording without consent (California residents) | CallRecordingClassAction.com |

| Eligible Calls | Between October 22, 2014 – November 17, 2023 | Official Settlement Site |

| Estimated Payout per Call | Around $86 (average) | Settlement FAQ |

| Maximum Possible Payout | Up to $5,000 per call (rare) | Settlement FAQ |

| Claim Filing Deadline | April 11, 2025 | Official Notice |

| Final Approval Hearing | May 20, 2025 | Court documents |

Understanding the $5000 Wells Fargo Settlement Payment

So what’s this settlement all about?

In 2025, Wells Fargo and several related companies agreed to settle a class action lawsuit over alleged unlawful call recordings in California. The lawsuit claimed that calls made by The Credit Wholesale Company, Inc. — acting on behalf of Wells Fargo and its affiliates — were recorded without proper consent between October 2014 and November 2023.

Under California law (CIPA), both parties must consent before a call is recorded. The lawsuit accused the companies of violating that law.

Rather than continue an expensive court battle, Wells Fargo agreed to a $19.5 million settlement fund. This fund will be divided among eligible claimants — people whose calls were recorded without notice — once the court gives final approval.

Why $5,000 is Misleading — The Real Payout

Here’s the thing: the “$5,000” number is technically correct but very few people will receive that much.

The settlement fund is capped at $19.5 million total. Once attorney fees, taxes, and administrative costs are subtracted, the rest is split among all valid claimants.

That means:

- If only a few hundred people file, each could get thousands.

- If tens of thousands file, the payout per person could shrink to a few hundred dollars — or less.

The estimated average payout is around $86 per eligible call, according to the official settlement website. Still, if you had multiple recorded calls, your total payment could be several hundred dollars.

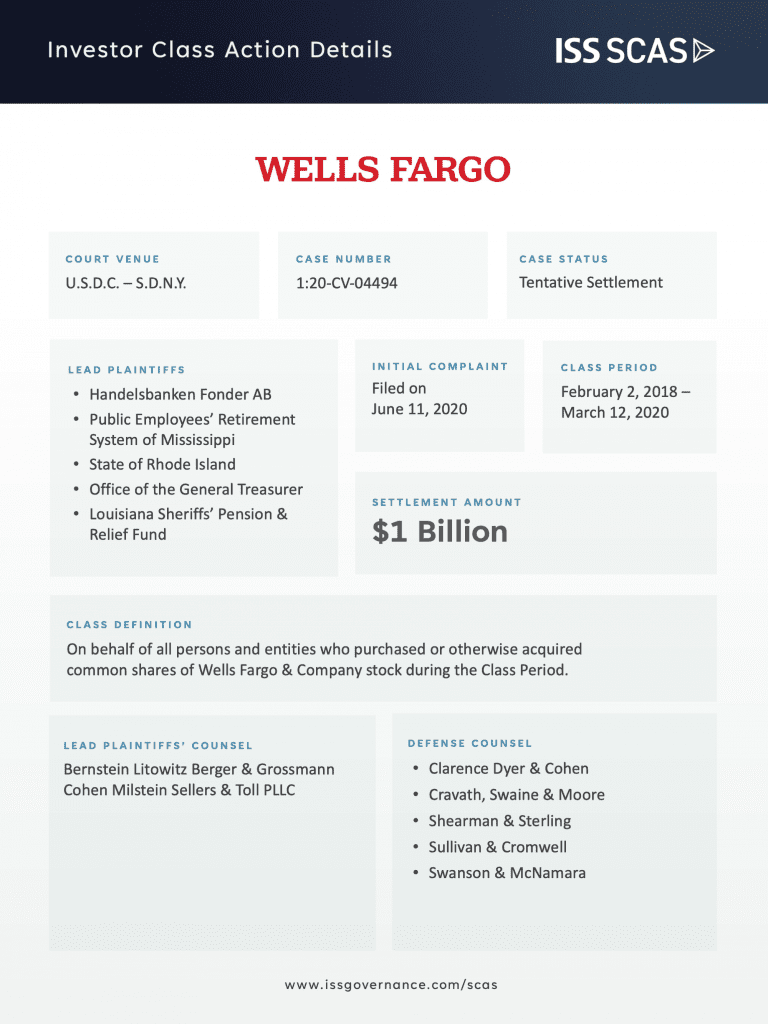

Wells Fargo’s Legal History: A Pattern of Big Settlements

Wells Fargo’s name has popped up in several major lawsuits over the past decade. Here’s a quick timeline for context:

- 2016 – Fake Accounts Scandal: The bank admitted that millions of fake accounts were opened without customer consent. The penalty? A massive $3 billion fine.

- 2022 – CFPB Penalties: The Consumer Financial Protection Bureau (CFPB) ordered Wells Fargo to pay $3.7 billion for mishandling auto loans, mortgages, and deposit accounts.

- 2024 – COVID Mortgage Forbearance Case: Wells Fargo settled another class action for $185 million, compensating homeowners who were improperly placed into mortgage forbearance during the pandemic.

This history is why so many people pay attention when Wells Fargo appears in new class action settlements.

Step-by-Step: How to Check Eligibility and File Your $5000 Wells Fargo Settlement Payment Claim

Step 1: Determine if You Qualify

You qualify if:

- You received a phone call in California between October 22, 2014, and November 17, 2023.

- The call came from or was made on behalf of The Credit Wholesale Company, Inc., acting for Wells Fargo.

- The call was recorded without your consent.

You don’t have to prove the recording yourself, but you should be reasonably certain that you received one or more of these calls.

Step 2: File a Claim

- Visit CallRecordingClassAction.com

- Complete the claim form online or print and mail it.

- Include your name, address, phone number(s), and any supporting evidence like phone records.

- If your potential payout exceeds $600, you’ll also submit a W-9 form for tax reporting.

Deadline: April 11, 2025. Don’t miss it — late claims will be denied.

Step 3: Wait for the Court’s Final Approval

The court hearing is scheduled for May 20, 2025. After that, payments will begin to go out — most likely in the second half of 2025.

You’ll receive payment by check or direct deposit, depending on your selection on the claim form.

Realistic Payout Scenarios

| Scenario | Number of Eligible Calls | Estimated Per-Call Payout | Likely Total Payment |

|---|---|---|---|

| One eligible call | 1 | $86 | $86 |

| Multiple calls (5) | 5 | $86 | $430 |

| Frequent contacts (10 calls) | 10 | $86 | $860 |

| Few total claimants | 10 | Up to $5,000 per call | $50,000 (rare) |

Again, that $5,000 per call is the upper limit. Most participants will receive between $50 and $500, depending on how many calls they can verify.

Tax Implications: Do You Owe the IRS?

Most likely, yes. According to the IRS, settlements that aren’t related to physical injury are considered taxable income.

If you receive more than $600, you’ll get a Form 1099-MISC the following year. You’ll need to report it on your tax return.

To stay compliant:

- Keep your payment letter and any tax form you receive.

- Consult a CPA or tax professional to understand how it affects your taxes.

- Check the IRS guide on Lawsuit Settlements and Awards for more details.

Beware of Settlement Scams

Unfortunately, scammers love to impersonate class action administrators. Here’s how to protect yourself:

- Only use the official website: CallRecordingClassAction.com.

- Never pay to file a claim — legitimate settlements don’t charge fees.

- Be skeptical of emails or texts claiming you “won a payout.” The real administrator will not contact you via personal text or social media.

Additional Wells Fargo Settlements You Should Know

If you’ve ever had an account, mortgage, or loan with Wells Fargo, you might be eligible for other settlements as well.

1. Wells Fargo COVID Mortgage Forbearance Settlement

- Total fund: $185 million

- Effective: February 15, 2025

- Automatic payments began: March 2025

- Claim deadline (for extra compensation): January 10, 2025

This one’s for homeowners whose mortgages were placed into forbearance without their permission during the pandemic.

2. Wells Fargo Overdraft Fee Refunds

In 2022, Wells Fargo refunded millions to customers charged improper overdraft fees and surprise account holds. If you had an account with recurring overdraft issues before 2022, you may already have received a refund or credit automatically.

3. Wells Fargo Auto Insurance Refunds

In 2021, Wells Fargo paid millions to customers wrongly charged for auto insurance policies they didn’t need. If you financed a car through Wells Fargo between 2012 and 2017, it’s worth checking whether you qualified for that settlement as well.

Expert Insight: Why These Settlements Matter

According to consumer-rights attorney Lisa Gilbert, “Class action lawsuits are often the only practical tool for consumers to push back against corporate misconduct. Even if each individual harm is small, together they make a huge difference.” (Source: CNBC, 2024)

That’s the key takeaway: even if you only receive $100, these cases force transparency and accountability from major corporations — something that benefits all consumers.

Tips to Make Sure You Get Paid

- File early — don’t wait until April 11, 2025.

- Double-check your information (especially your mailing address).

- Save a screenshot or print copy of your claim confirmation.

- Watch your mail and email for updates from the settlement administrator.

- Don’t toss any check you don’t recognize — look for the settlement logo or administrator name first.